Highlights of the week in finance, investment, emerging-markets, risk, and crypto markets from Lima Charlie Business Intel.

2018 Global Elections to Watch and Their Impact on Emerging-Market Investors

Emerging-market investors have their eyes set upon 4 major investments, whose sovereign bonds and corporate stocks are traded by millions of Americans every week: Brazil, Malaysia, Mexico, and Colombia.

All 4 countries have one thing in common in 2018—not only are they all emerging markets—nations which are investing more in productive capacity and prove to be the most attractive grounds for investors based on metrics like current-account position, growth, yields, and asset valuations—they are all gearing up for critical elections in 2018.

According to one major investment bank, these countries are the key ones to monitor. As published last week in its inaugural Emerging Market Electoral Monitor, UBS marks 2018 as a “year rich in leadership turnover.” Although the importance of elections to financial markets can sometimes be overrated, given that recently turned leadership often softens its more fringe positions to a centrist outlook upon election, the upcoming elections have the definite “potential to move markets,” as expressed in the report.

Highlights for the upcoming elections and their projected impact on key market trends, national assets, and overall economic stability for potential investors:

Brazil

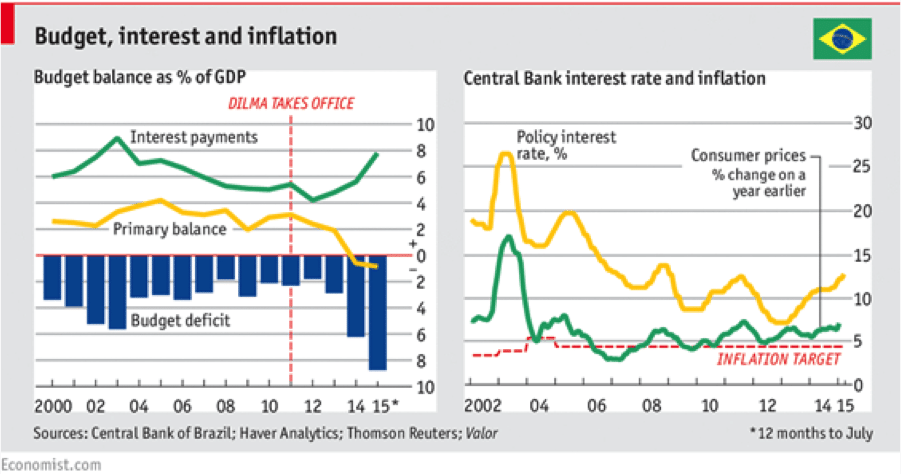

Current State of Economy: Following a three-year recession, Brazil is in the midst of a typical economic recovery, sparked by the return of political confidence coupled with stringent monetary policy. Following the tightening of inflation and the cutting of interest rates in half, the unemployment rate in Brazil dropped to an 11-month low of 12% in February. According to the report, the economy “decoupled from politics in the last year” combined with effective reform such as a spending cap and labor market laws.

Future Potential for Economic Reform: The need for comprehensive fiscal and economic reform is critical, despite the gains made in overcoming the recession. Many economic experts have suggested a higher investment in infrastructure policy targeted toward raising national savings, and opening up a largely closed economy. The incoming administration will need to tackle these important issues as it prepares to move the country forward.

Potential Economic/Market Impact of Election: Experts suggest that, with the likely ascension to power of a centrist or center-left candidate, Brazil is projected to increase its GDP growth potential to 2-3% annually in the coming four years. With respect to the market, experts portend the country returning to an investment grade credit rating path, higher return on equity, and lower real interest rates. Alternatively, should a leftist win the election, real interest rates could prove higher and the GDP growth potential would likely be cut. In the case of a right victory, the path would likely follow that of the centrist candidate, though potential for fluctuation is always possible.

Malaysia

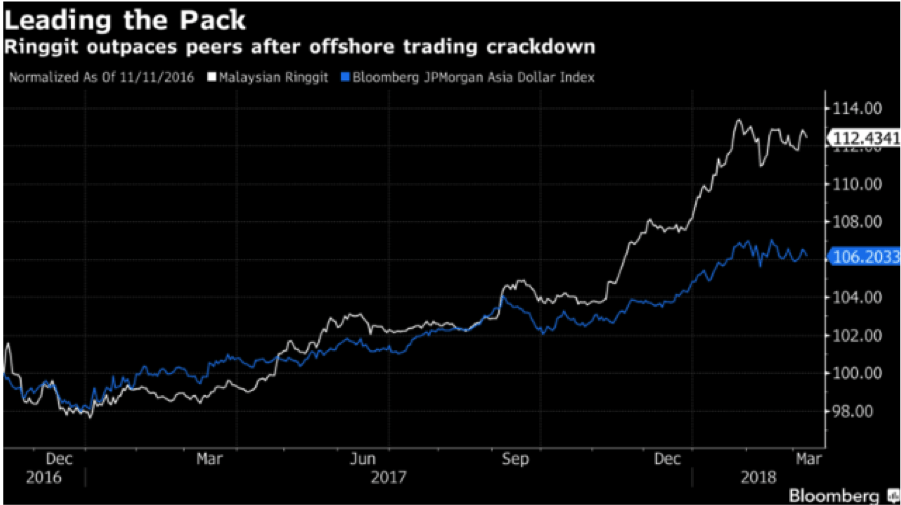

Current State of Economy: According to research conducted by the International Monetary Fund, Malaysia is inching closer toward high-income status as an economy. In the face of extra-national shocks, the economy continues to grow at a continued pace, as detailed in the 11th Malaysia Plan which provides a path forward from 2016 to 2020 toward reaching advanced economy status upon a foundation of human capital development, infrastructure, inclusiveness, equity, and environmental sustainability. Economic growth continues to strengthen, with the help of robust domestic demand, and spending is projected to be front-loaded. Experts predict the central bank, Bank Negara Malaysia will likely hike rates further in 2018, following 25 basis points in January.

Potential Economic/Market Impact of Election: Incumbent right-wing political party Barisan Nasional is likely to hold power, as the largest party in the Parliament of Malaysia. Macroeconomic data bolsters the party going forward. Experts expect the status quo to be maintained if the party does remain in power and the investment environment is likely to remain conducive for foreign investment. The opposition, Pakatan Harapan, which just launched its 60-point election manifesto is unlikely to take power, but has pledged to abolish a goods-and-services tax and investigate scandal-plagued state investment firm 1Malaysia Development Berhad within its first 4 months in office. In the unlikely case that the party is successful, experts expect the equity market and the Ringgit to grow weak, along with the stalling of infrastructure and the slowing of foreign investments.

Mexico

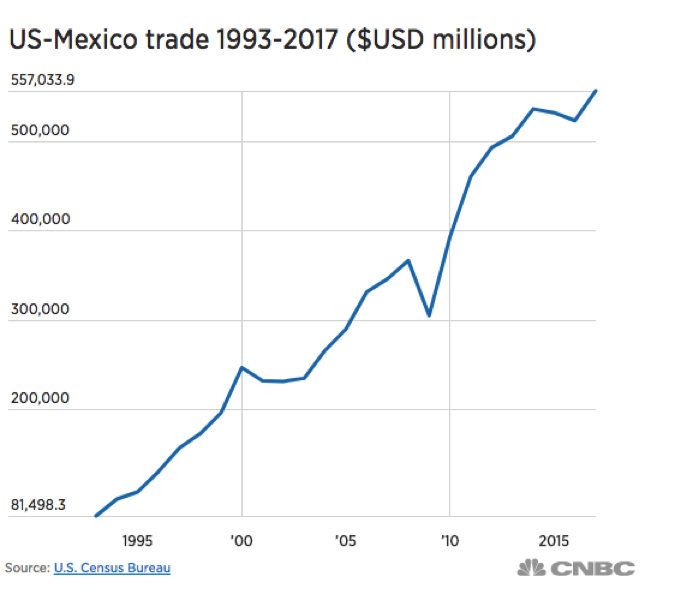

Current State of the Economy: While Mexico is exhibiting strength, the uncertainty for the country in light of the North American Free Trade Agreement negotiations has thrown some instability into the mix. This could likely impact future Gross Domestic Product growth but experts expect the economy to exhibit resilience to shocks. Strong manufacturing exports to offset falling oil output and weaker construction activity stalled by ongoing budget cuts since 2015 are built in to projections for the country.

Potential Economic/Market Impact of Election: Andres Manuel Lopez Obrador, whom many call the bête noire of Mexican markets, is likely to win in the upcoming July election for president. The left-wing politician’s victory could result in the already strained relations between Mexico and the US growing even tenser. AMLO has consistently spoken out against President Trump. From the beginning of NAFTA through last year, trade relations between the US and Mexico have sharply increased consistently and in 2017, trade between the neighboring countries was almost 557 billion dollars in goods—the highest ever recorded.

The frontrunner’s policy program hinges on the concept of Mexico as a country whose “neoliberal” policies under the last 3 administrations have reaped disaster on its social and economic arenas. AMLO proposes a much greater involvement of the state in the economy, in contrast to private sector initiative and has promised to end privatization of Pemex and the electricity industry. He has also come out against the exploitation of mining resources by private hands. AMLO has even said, “We are going to produce what we eat. We will no longer buy from outside the country,” signaling that a victory for his party would drastically change the status quo and put a strain on Mexican assets.

Alternatively, a win by the Partido Revolucionario Institucional or the Partido Acción Nacional would signal a continuation of the macro-focused policies of the status quo and less of a weight on Mexican assets.

Recent Developments and Potential for Market Impact: In its first review of Mexico’s energy policies in 2017, the International Energy Agency (IEA) noted that the broad-based reform of the energy sector, heralded in 2013 by the constitutional changes, has reached impressive heights. Despite beginning as a largely closed and monopoly-driven energy market, the changes have allowed for distinct steps in the direction of harnessing market forces to attract investments and increase transparency and rule of law. In 2018, Mexico became the 30th member of the IEA, as the organization welcomed its first Latin American member in an effort to strengthen connections with emerging economies.

Colombia

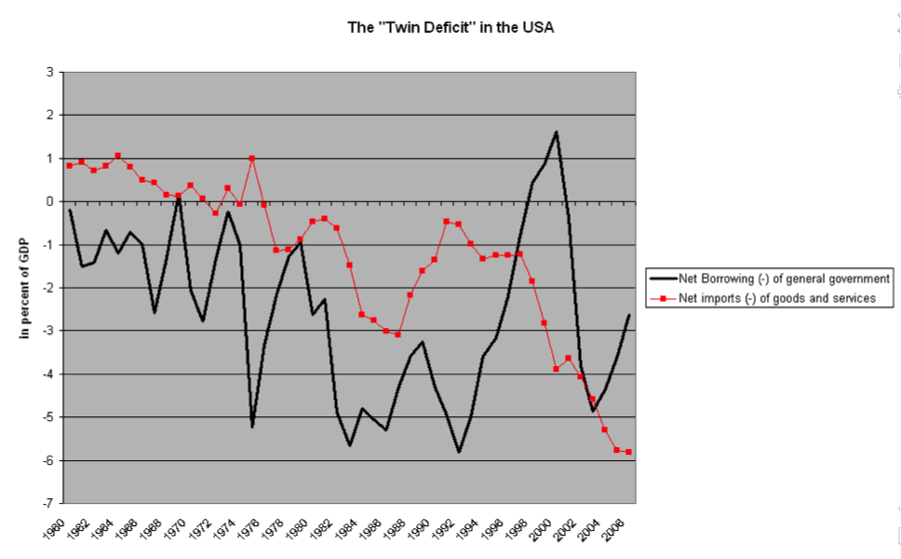

Current State of the Economy: According to a recent Colombia Energy Investment Report by the Energy Charter Secretariat, the energy sector in the country has been fundamental to its economic development and to the potential for increasing private investment and employment prospects. However, the economy is currently recovering from low global energy prices as GDP growth attempts to make up for these losses. Furthermore, Colombia has experienced a drop in crude exports, averaging just over 600,000 barrels a day. The fall came in the midst of the temporary ceasefire between the Colombian government and the National Liberation Army (ELN). The country is also in the middle of double deficits, as economic literature describes the correlation between current account deficits and fiscal deficits, known as the twin deficits hypothesis. As a domestic point of reference, the budget deficit is financed approximately half intranationally and half from abroad. Economies with both a fiscal deficit and a current account deficit are said to have “twin deficits”—a categorization which the US has fit for some time, as illustrated below for the years 1960-2006 (Credit: Macro-economic database AMECO | European Commission). In the Colombian case, the twin deficit leaves the country susceptible to changes in global liquidity conditions, as it impacts the emerging economy.

Potential Economic/Market Impact of Election: PHD Mathematician Sergio Fajardo is looking to replace President Juan Manuel Santos in the upcoming election as the country continues into a cautiously peaceful relationship with the FARC Marxist guerrilla group. Colombia is Latin America’s fourth-largest economy and Fajardo will likely compete in a second round with a Democratic Centre party opponent. Given the party’s ties to former President Alvaro Uribe, the group will receive his backing, but experts predict that Colombia’s responsible macroeconomic framework is likely to remain in place regardless of the victor. On the other hand, if Petro—a former member of the left wing M-19 guerrilla group and prior Mayor of Bogota, wins, Colombian assets are likely to be negatively impacted, as are overall prospects for markets.

For past coverage from Lima Charlie of the unfolding events in Malaysia, Brazil, Mexico, and Colombia, check out our continued Foreign Policy, Business, and Politics coverage.

China: Impact of Restored Silk Road, Port of Djibouti, and Indo-Chinese Geopolitical Tensions on Markets

Following last week’s successful efforts to eliminate presidential term limits and enable Xi Jinping to reign over China for a generation, as Lima Charlie reported on, there was a great deal of uncertainty, but one thing remained certain: moving forward, investors’ China portfolios will increasingly be dictated by one individual. While the President’s term over the last 5 years has allowed for a degree of economic stability coupled with fluctuations of volatility, the centralization of power under Xi is seen as a positive move from the perspective of many investors, although it does lead to future conflicts with accountability and a lack of gridlock to slow down swift decisions made by the leader. As reported by Reuters Shanghai, Chinese investors immediately jumped on stocks with any link to the word (or the native translation of) “emperor,” including Shenzhen Emperor Technology, Vatti, and Huangshanghuang.

Furthermore, following Xi’s 2013 announcement for the One Belt, One Road (OBOR) initiative, it is clear now that China’s ambitious trillion dollar project is poised to make Khorgos—located in the country’s westernmost province, Xinjian—the globe’s busiest dry inland port. The province will be a linchpin in a desire for inclusive globalization that will allow short-term Chinese growth to elevate sharply and create burgeoning markets in the long-term. While Khorgos is located on what has been called the “Sea of Death,” on the edge of the Taklamakan Desert, the vibrant impact on global markets and investor potential for the country is ever-widening.

According to US Pacific Command—which has echoed the sentiments of US intelligence agencies, a warning has been issued that tensions are flaring between longtime rivals in the Asia-Pacific region, namely between India and China. Breaking from the actions of other Asian countries, India has turned down requests to be a part of China’s ambitious One Belt, One Road effort. Prime Minister Narendra Modi has spoken ardently, through his Act East Policy, urging foreign investment in his country’s impoverished northeast. He has even requested the assistance of neighboring Southeast Asian countries to provide the funds for investment. The main conflict for India in this particular circumstance is that the one nation with the power and technological infrastructure to assist India’s northeast is the only country India would likely not accept aid from: China. Geopolitical communication between the two countries continues to be tense and, simultaneously, China’s neighbors do not possess the capital to a substantial part of its excess capacity in its One Belt, One Road initiative. While China possesses the infrastructure, it desperately needs markets and, following China and Japan, India has the third largest one. On the flip side, India has the market but desperately needs the infrastructure.

Furthermore, in China’s efforts to expand geographically, the US has been drawn into the economic, political, and geopolitical situation. Earlier this week, the highest-ranking US general for Africa advised lawmakers that the military could face major consequences in the event that China takes the critical port of Djibouti. Djibouti recently ended a contract with Dubai’s DP World, one of the globe’s largest port operators. According to investment bank Grisons Peak, Chinese groups are announcing plans to invest in or fully buy nine overseas ports totaling about 20.1 billion dollars.

For more reporting on China’s efforts to restore the lost majesty of the famed Silk Road, check out Lima Charlie’s continued coverage here.

Cryptocurrency and the Markets

Global Spy Platform Seeks to Diminish Investor Risk in Cryptocurrency Market

Although initial coin offerings (ICO’s) have skyrocketed in popularity, raising upwards of 4 billion dollars last year, more than 70% fail—exposing investors to a great deal of risk in this arena. In this 600 billion dollar industry, thousands of investors are adding to their portfolios and crypto assets, but many seek the necessary safety net that is so lacking in this area.

In the wake of this uncertainty, Global Spy—an investigator platform for cryptocurrency investors—proposes a creative solution to this problem by putting forth a blockchain-based cryptocurrency research service for users. Through the acquisition of Spy coins, the platform will conduct research on a particular cryptocurrency or initial coin offering, providing necessary due diligence for such a high-risk, high-stakes decision.

The going rate is 5000 Spy Tokens for 1 Ethereum, with an expected 5% bonus in the second week and a 20% uptick in the first.

Beginning on March 15th, the program will provide investors with bonuses correlated to when they joined the ICO. The whitelist can be joined here.

Bitcoin Takes a Dive as BitCNY Provides More Stability

Friday afternoon, Bitcoin dropped below $9,000, a continuation of losses incurred when it dipped below the critical $10,000 threshold to finish off at an overall 24% decline for the week.

The market for the currency took a dive following a statement made earlier in the week by the Securities and Exchange Commission which will now require online platforms trading digital assets that are considered securities to register with the SEC. The effort was carried out in an attempt to create a clear distinction between non-securities and securities. A 24-hour analysis of Bitcoin’s performance following the announcement is illustrated below, as provided by Coinbase:

With high levels of uncertainty, another smart coin currency—known as BitCNY—has received much media attention. Some experts see the currency as an effective long-term hold in the midst of the unpredictability of the current market. BitCNY is a cryptocurrency whose trading is up 8.6% this week, pegged to Chinese currency, the Yuan. The market for the currency arose due to users’ needs for equal purchasing power as the Yuan and the capability to go through with transactions using the currency. BitCNY was launched in 2014.

View more of Lima Charlie’s Cyber and Business coverage here, including updates on topics like cyber espionage and cyberwarfare from our Middle East Bureau Chief, John Sjoholm.

Women’s Day and Behavioral Finance

Following International Women’s Day on Thursday, March 8th, calls for more equitable wages, rights, and inclusion for both sexes rang out around the world. In particular however, one rapidly closing margin of inequity that has seen major impact on portfolios and investment is in women’s overall market wealth. According to the Economist, citing the Boston Consulting Group, between 2010 and 2015, private wealth held by women rose from 34 trillion dollars to 51 trillion dollars. As a portion of all private wealth, women’s wealth also experienced an uptick from 28% to 30%. In just two years, women are projected to hold 72 trillion dollars, or a little under one-third of the total.

The impact of these statistics for risk-assessment and asset management is likely to be major. According to the IZA Institute of Labor Economics, there are stark differences in risk attitudes between the genders: while women are more likely to purchase and retain, men are usually more ready to buy rapidly. Investors view this as a tendency to consider risk more carefully among the former, than the latter.

In the burgeoning cross-field of cognitive psychological theory and conventional economics and finance—better known as behavioral economics—studies have shown that, in 2014, women outperformed men by 12% on the stock market and lost 2.5% on their portfolios on average, compared to 3.8% for men. This study indicates a higher understanding of risk-related consequences among women and an increased tendency among women to mention particular financial goals among their overall objectives versus men, who are more likely to mention outperforming the market as their top investment goal.

From these trends emerges the growing practice of gender lens investing (coined in 2009), whereby the practice of investing for financial return is weighed in consideration with the effects on women. A 2017 Wharton study surveyed private equity funds through such a gender lens, representing a growing effort—specifically permeating the markets of finance—to create gender-equality exchange-traded funds (ETF’s).

View Lima Charlie’s recent coverage of International Women’s Day.

Rex Tillerson, African Sovereignty, & Chinese Investment

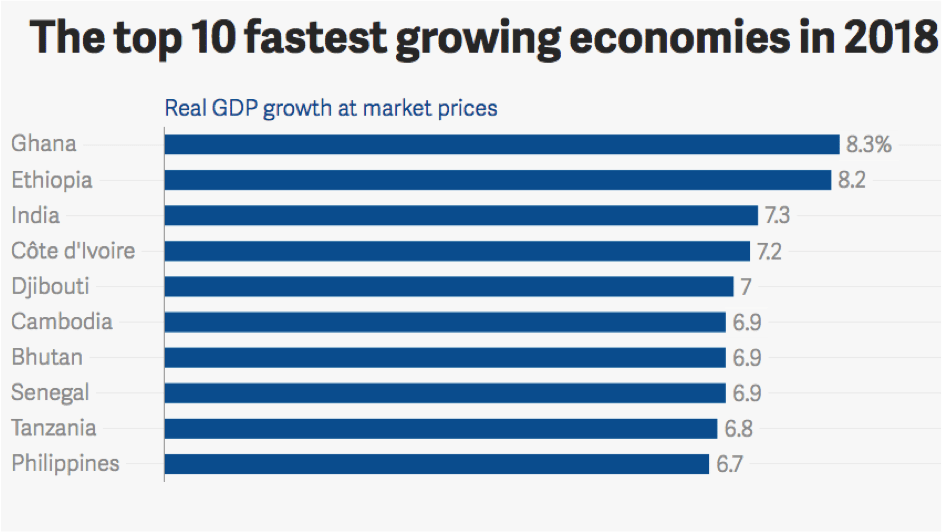

According to The World Bank, projected figures of 3.2% growth in 2018 and 3.5% growth in 2019 for sub Saharan African economies are likely to be reached. Non-commodity intensive economies comprise the majority of this year’s highest performers, thus far: Ghana (8.3%), Ethiopia (8.2%), Côte d’Ivoire (7.2%), Djibouti (7%), Senegal (6.9%), and Tanzania (6.8%).

Of particular note, the continent itself has 6 of the 10 fastest growing economies in the world in 2018 as of March (Credit for image: The World Bank).

During a five-nation trip to Africa, US Secretary of State Rex Tillerson cautioned African states against building up high levels of debt from China, an eager creditor. Prior to departing for the trip, Tillerson delivered a speech encouraging African nations to beware of predatory loan practices, opaque contracts, and attempts to undercut their sovereignty. In a statement from the Ministry of Foreign Affairs of the People’s Republic of China, the Communist Party responded to the concerns by stating, “China welcomes the diversification of Africa’s international partnerships and sincerely hopes that various parties of the international community can increase inputs in Africa.”

Tillerson spoke of his support for investment on the continent, while also providing a cautionary message to prevent the country from losing control of its own infrastructure or resources due to a faulty deal.

US-China-Africa geopolitics played a major role in the announcement especially given that Beijing pushed past DC as the largest trade partner with Africa in 2009.

Perhaps the most important line-item on Tillerson’s trip to Africa that will critically impact US markets is the large unilateral concessionary agreement the US Congress has reaffirmed which would allow African products preferred access to U.S. markets. The Act, known as the African Growth and Opportunity Act will prove a key factor in where America falls in relation to emerging market economies, namely China, in trade and investment in sub-Saharan Africa.

View Lima Charlie’s recent coverage of the unfolding events in Africa as well as our weekly Middle East North Africa brief.

February Jobs Report Release and Interplay With Markets

On Monday, the Dow fell by 4.6% (1,175 points), the worst point decline ever, in comparison to the September 29, 2008 777-point fall. Stocks from the largest US multinational corporations felt the drop especially in the wake of the Trump administration’s recently established aluminum and steel tariffs.

On Friday afternoon, the Dow surged 441 points following the government’s release of its most recent jobs report—for February 2018. Figures show the US economy added upwards of 300,000 jobs in the last month with unemployment remaining steady at around 4.1%, for the fifth month in a row. Impressive gains from low to middle to high wage industries produced the most jobs since July of 2016. While the report did not have an immediate impact on the Forex market, it carried with it the strong forward movement of the economy. Perhaps one of the most important projections is that the figures are steady enough to predict that the Federal Reserve will raise interest rates in late March.

While investors were cautious after January’s high-figure jobs report was followed by massive losses for the stock market, by week-close, even Europe finished in the black with pan-European STOXX 600 rising 0.43%.

Asian equity benchmarks and markets also finished the day higher, coupled with confirmed news of a meeting between President Trump and North Korean leader Kim Jong-un. Steel stocks in Korea and Japan, however, took a hit, following news from DC that the US would levy tariffs on steel and aluminum.

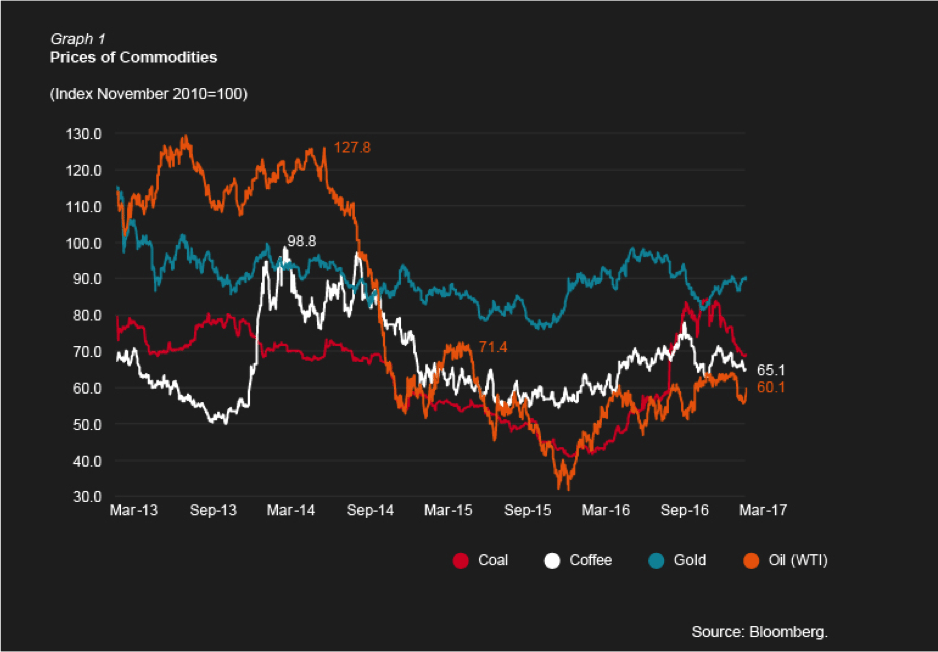

At week-close, emerging markets stock rose 1.06%, with crude prices rising along with it by 3.28% to $62.09 per barrel. Copper rose 1.82% and US gold futures gained 0.17%.

LIMA CHARLIE NEWS

[Edited by Nikita Roach]

Lima Charlie provides global news, insight & analysis by military veterans and service members Worldwide.

For up-to-date news, please follow us on twitter at @LimaCharlieNews

In case you missed it:

![Image This Week in Business Intelligence [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/03/This-Week-in-Business-Intelligence-Lima-Charlie-Business-Intel-Report.png)

![Image Drop in oil prices may trigger unintended consequences [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/11/main_900-480x384.jpg)

![Image This Week in Business Intelligence [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/03/This-Week-in-Business-Intelligence-Lima-Charlie-Business-Intel-Report-480x384.png)

![Image Memorial Day may soon be a remembrance of democracy and those who had the courage to defend it [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/05/Memorial-Day-may-soon-be-a-remembrance-of-democracy-and-those-who-had-the-courage-to-defend-it-Lima-Charlie-News-480x384.png)

![The Mind of Bolton - AUMF and the New Iran War [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/05/Inside-the-mind-of-Bolton-Lima-Charlie-News-main-01-480x384.png)

![Image Drop in oil prices may trigger unintended consequences [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/11/main_900-150x100.jpg)

![Image This Week in Business Intelligence [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/03/This-Week-in-Business-Intelligence-Lima-Charlie-Business-Intel-Report-150x100.png)