Highlights of the week in finance, investment, emerging-markets, risk, and crypto markets from Lima Charlie Business Intel. This week’s report covers Democratic Republic of Congo, Kinshasa, Colombia, Argentina, Bolivia, Chile, Ontario, Norway, Bahrain, Persian Gulf, Greece, Ethiopia, Nigeria, Iran, China, Zimbabwe, the Philippines, Brazil, Russia, Singapore, Australia, Japan, Germany, Vietnam, South Africa, Malaysia, Mozambique, and the United States.

Upcoming Election Spotlight: Colombia

Colombian Election To Test Waters for Investors and Regional Market

While civil strife in Colombia was largely quelled by an agreement between the rebel FARC group and the nation, the March parliamentary elections marked the first time the FARC, now disbanded as a political group, would send representatives to Congress. The group performed poorly, receiving less than 0.4% of the vote. Nevertheless, the group is guaranteed 10 seats in the legislature, as per the peace deal.

For investors, the country’s outlook as an investment grade credit was downgraded to “negative” by Moody’s Investor’s Service.

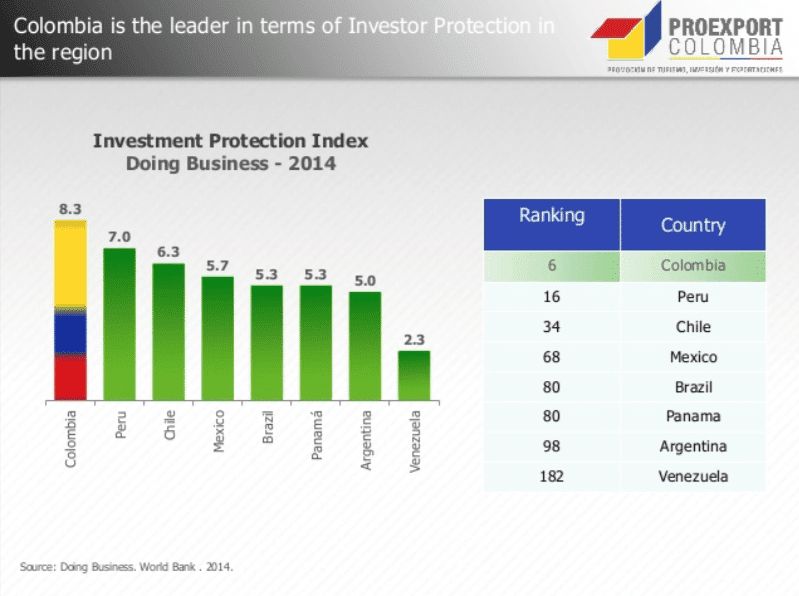

In 2011, however, the country was ranked first in investment protection among nations in the region, as seen below.

Growing tensions that a leftist could win the presidency in the upcoming May elections have injected an aura of uncertainty into the investor climate and, as a result, the Colombian peso has weakened. Leftist former mayor of Bogota, Gustavo Petro, has even seen an uptick in popular support, a former M19 guerilla. Petro is a great risk to investors, both foreign and domestic, especially given his opinions on restructuring Colombia’s petroleum and resource dependent economy. His plan is to convert the country into one focused on agriculture and industry.

The Colombian Presidential Election will take place on May 27, 2018 and, in the event no candidate receives a majority of the vote, the second round will take place on June 17. Current President Juan Manuel Santos has reached the maximum two-term limit and is ineligible for election.

Investors will be keeping a close watch on the poll numbers, in the hopes that the leftist candidate reduces popular favor among the electorate and a wave of stability may fall over the nation.

Historic Port of Banana Brings Newfound Optimism to Investors in DRC

DP World, whose maritime portfolio currently consists of 77 operating marine and inland terminals across 6 continents, just won a 30-year concession for the development of the world’s first deep-sea port in the Democratic Republic of Congo.

The Greenfield port endeavor is set to take place in Banana, Democratic Republic of the Congo, with DP holding 70% control and the DRC government holding 30%.

From an investor perspective, the project will provide the DRC with an ingress into global trade lanes and markets and, thus, release it from reliance on neighboring ports.

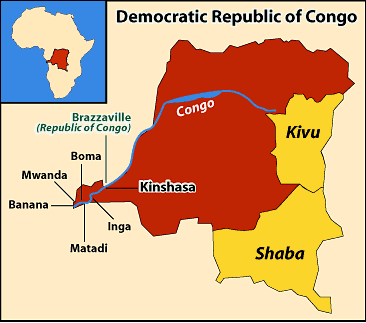

The DRC has no deep-sea port and, given that its current ports at Matadi and Boma are inland upstream on the Congo River, the sites are not able to cope with the traffic from conventional ocean-going cargo liners. The image below shows the location of these ports geographically.

The mineral-rich nation—equipped with reserves of cobalt, cassiterite, and oil—will now open up opportunities for up to $2 billion dollars in new shipments.

The Port of Banana site will have a capacity of 350,000 teu and 1.5m tonnes of general cargo after the first phase of the project.

The country’s coastline spans just 37km and DP’s move to extend its African footprint represents a watershed moment for the country which will now be able to shoulder its own shipments independently of neighboring ports.

(The image below presents a view of Banana, Congo, which is about 232 miles southwest of Kinshasa the capital of the country. | Credit: TripMondo.)

Investors in Battery Metals Space Eye Newcomer Competitor to South American “Lithium Triangle”–Holder of Over Half the Planet’s Lithium

Power Metals Corp, self-described as one of Canada’s newest premier mining companies, is attracting the attention of many investors in the battery metals space.

The face of lithium is poised to change forever as a new rock is set to surpass the rock known for its reserves in Argentina, Bolivia, and Chile—forming the South American triangle which contains over half of the planet’s lithium. An image of the region is presented below.

As demand for lithium batteries soars through products like electric cars, a new discovery of the rock pegmatite has been unearthed in large reserves in Ontario, Canada. Power Metals is hard at work drilling in the region at a rate of 15,000 meters this year, scattered across 9 domes of the precious mineral. The company has even brought Dr. Julie Selway, a geologist globally heralded as the “Queen of Pegmatites” onto its team.

For investors, the company is particularly attractive because of the tax benefits associated with Ontario lithium mining. The region provides a flat 10% mining royalty and no tax on the first $10 million in yearly sales for three years in a freshly dug mine.

In comparison, the Lithium Triangle, which straddles Chile, Argentina, and Bolivia, does not have the same sense of predictability and business-friendly environment of the Ontario site, which is not good news for investors. Global lithium resources by ton are presented below (source: Economist)

Power Metals is setting itself apart from competitors by its focus on pegmatite, whereas other companies have only looked into brine, another source of lithium.

Countries like Bolivia have also been focusing heavily on brine. An image below from Salar de Uyuni, Bolivia shows Bolivia’s salt flats, the largest on the planet. Below them, almost half of the world’ lithium reserves rest.

With spring in the forecast for the region and a fully budgeted proposal, drilling projects are set to begin soon and investors are keeping close watch over what is likely to become a leader in the lithium mining industry.

World’s First Autonomous Shipping Line Formed, Marks Turning Point for Global Shipping Industry

Massterly will become the world’s first autonomous shipping joint venture—a coalescence of Norwegian maritime groups Kongsberg and Wilhelmsen. Just last year, Kongsberg and Yara International inked a deal to build the globe’s first fully-electric autonomous contained vessel, Yara Birkeland.

The investor market for autonomous ships is likely to burgeon as a result of the deal heralded by the shipping capital of the world.

The move marks a turning point for the industry and investors in the space, given that removing the necessity for a crew and fuel will save up to 90% in yearly operating costs.

With the new technology, comes a reduction in the risk of piracy, given that the lack of crew and hostage-taking scenarios is a definite plus of the new development. The economic cost of Somali piracy was $1.7 billion last year.

The Yara Birkeland will test the new vessel and have remote operations in 2019 and full autonomous operations by 2020. The Rolls-Royce Marine venture is another major industry player which heads the Advanced Autonomous Waterborne Applications Initiative (AAWA) and is set to roll out a short run of an autonomous vessel in 2020 and an ocean going one by 2025.

The image below (source: Tech Crunch) presents a projection of the autonomous vessel, which is set to travel at 6 knots during its first few months.

Investment in companies that are on the cutting edge of this unmanned vessel trend is a key space of interest for investors in the autonomous vessel global shipping industry.

Bahrain Makes Historic Oil Discovery

Bahrain made a discovery of the largest oil field in the country’s history, this week, announcing an estimated 80 billion barrels of tight oil off the west coast of the kingdom.

Tight oil is often found in tight sandstone or shale and is a light crude oil, and the resource boasts positive gains to be made for the kingdom’s economy and industries.

From an investor perspective, the country’s increasing public debts have resulted in many investors losing confidence in the nation, but the new discovery is likely to spike investor interest.

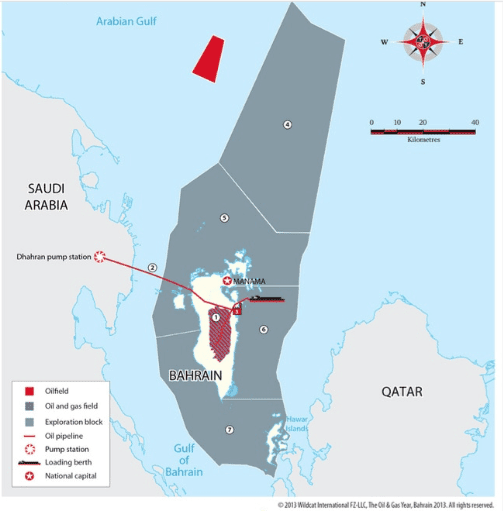

Bahrain is the smallest oil producer in the Gulf Cooperation Council and its primary source of revenue comes from two main oil fields, the onshore Bahrain field and the offshore Abu Safah field which it shares with Saudi Arabia.

The image below shows four of Bahrain’s offshore exploration blocks prior to the discovery of the new oil field (credit: Wildcat International)

The discovery increases the competitive strategic position of the country given that it is only one of two countries of the Persian Gulf that is not a member of the Organization of the Petroleum Exporting Countries (OPEC).

For global developments on oil extraction, especially the much-anticipated British exploration of UK shale extraction and its impact on markets, read Lima Charlie’s recent article by Dr. Gary K. Busch

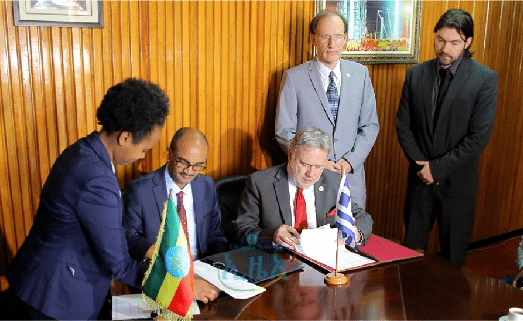

Greece and Ethiopia Sign Maritime Agreement One Year After Centennial of Diplomacy

This week, Greece provided investors with great optimism as it signed a maritime agreement to allow Ethiopians job opportunities on Greek vessels. Seafarers from the African nation will now be able to work on the largest fleet in the world, opening the Greek market of business to Africa, beginning with the country on the Horn of Africa.

Ethiopia has recently found itself in a state of emergency and, amid the election of a new leader in Addis Ababa, Dr. Abiy Ahmed Ali, opportunities to jumpstart the economy abound in the new climate.

Geopolitically, Greece plans to restore the direct flights from Ethiopia to Greece to further abet its efforts to strengthen business relations and more than 25 entrepreneurs are looking into investment opportunities with individuals in Addis Ababa.

Last year marked a century old diplomatic relationship between Greece and Ethiopia, and economic and maritime partnerships like those above demonstrate continued efforts to strengthen these ties going forward, especially for investors and business interests in the region.

Nation-State Hacking Sees Iran Eclipse China

According to a recent FireEye report, Iran has been named one of the most prolific and pervasive nation states last year.

The country has most notably deployed the Shamoon attacks on targets including Saudi Aramco, prompting many geopolitical analysts to consider whether the US will in fact back out of the Iran nuclear deal. The decision could result in retaliation by Iranian actors who may target US financial institutions.

Reports have even surfaced that the Iran-based hacker group known as Chafer has expanded international operations, moving its focus to other countries in the Middle East.

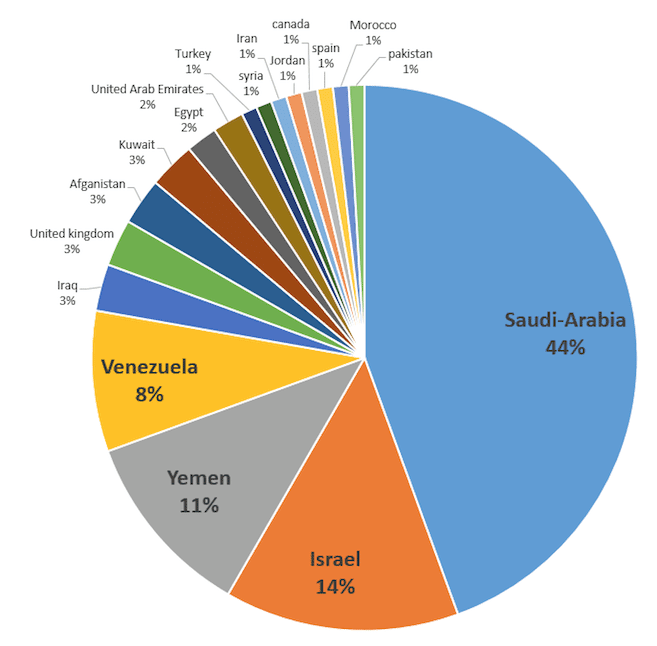

The below FreeBeacon graphic presents the focus, by percentage, of recent Iran-state attacks.

Exclusive African Cryptocurrency & Africa Blockchain Foundation Set to Launch Africa into Crypto Market

Africa is widely noted as the next major market for cryptocurrency.

For instance, many countries on the continent find themselves amidst high inflation, especially Zimbabwe and South Sudan. The cryptocurrency market could offer a sense of safety given its decentralized format.

As such, the Africa Master Coin is set to launch, the product of Trapeace Holdings and Cronet PTE LTD, a Korean and Singapore-based firm.

The Africa Master Coin will open the opportunity for public trading and will be uniquely African, offering fixed value private tokens for all participant countries and partnering with supermarkets and retail stores to create a security backed guarantee.

Investors are eyeing the opportunity, as the coin will bolster cross-border payments among nations on the continent .The tokens will be fixed at a constant value to local currencies.

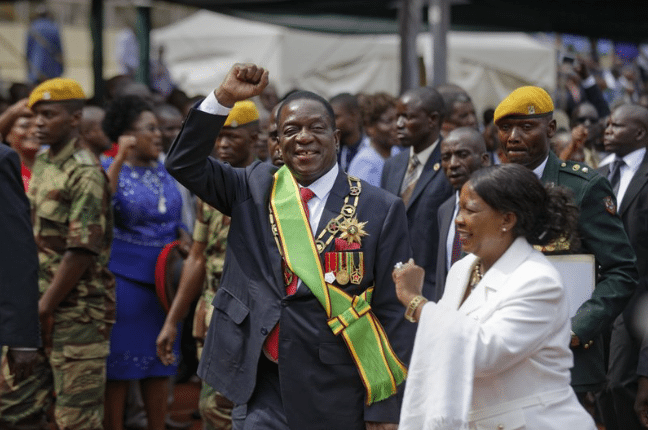

The President of Zimbabwe, Emmerson Mnangagwa, has even expressed support for the idea, saying it is likely to offer his citizens increased protection against hyperinflation, volatile currency, and overall uncertainty.

(The image below shows Mnangagwa’s election victory. | Source: AP)

Overall, the continent is set to make large gains in crypto territory as BitHub Africa-based in Nairobi—is providing funds to regional startups to increase blockchain adoption.

Furthermore, a recent report found that Nigerians are trading almost $4 million dollars in Bitcoin per week on 13 local exchanges.

With Africa Blockchain Foundation and Africa Master Coin set to launch an exclusive African crypto brand, investors are looking to Africa as the next leading growth continent in the cryptospace.

China, Philippines Quell Rising Tides in South China Sea

A “golden wave” of coalescence between China and the Philippines is seemingly upon the region, as the two countries are reportedly set to engage in a set of resource-sharing agreements in the South China Sea.

The neighboring countries have agreed to seek “offshore oil and gas exploration” plans based upon a “suitable legal framework” which will respect the sovereignty and interest of both nations.

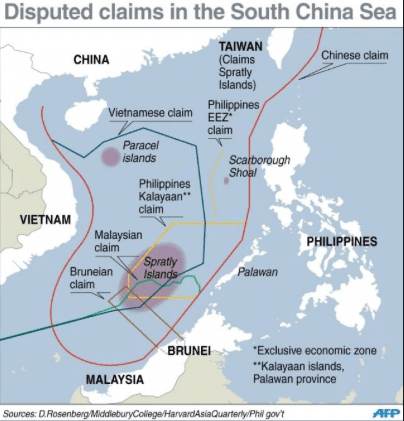

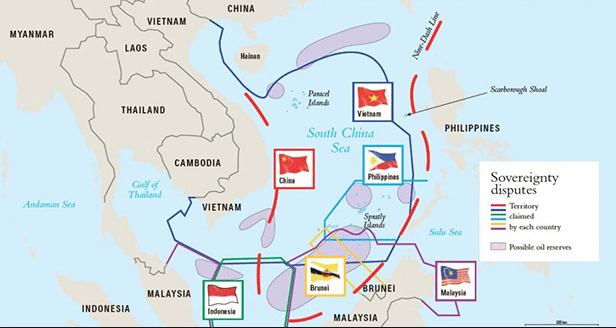

Geopolitically, China is looking to increase its sphere of influence in the Sea, in particular, as it detailed in its nine-dash line. The disputed claims in the region are shown below (source AFP).

China’s nine-dash line and sovereign claims in the region are shown below (source ChinaUSFocus).

Connecting the dots to recent economic and trade decisions, however, the Philippines is likely looking for increased security amidst the tense trade spat between the US and China. On Thursday, President Trump announced he ordered trade representatives to consider an additional $100 billion dollars in tariffs on Chinese goods. Given that 16.9% of the Philippines’ total exports are part of China’s value chain, the country is at high risk amidst the rising economic punitive measures.

The region poses great oil prospects with an estimated 344 billion barrels of oil and 30-70 trillion cubic meters of natural gas in the reserves.

From a military intelligence standpoint, the Philippines has widely been predicted to be ISIS’ next stronghold. China has been a strong player in attempting to aid the Philippines in this fight, sending 3,000 assault rifles and 3 million rounds of ammunition to the country in 2017 to guard against the ISIS-sympathetic Maute Group rebels.

The rising trade tensions between the US and China, combined with the strengthening bond between China and the Philippines going forward, will speak volumes about Beijing’s and DC’s abilities to exert influence in the Asia Pacific.

Cyber

Hackers Make New Play To Get Unsuspecting Website Visitors To Mine Cryptocurrency For Them

The new trend in cryptohacking allows for malicious actors to modify the script on frequently-visited browser ads which redirect to a crypto mining platform and indirectly mine cryptocurrency illicitly.

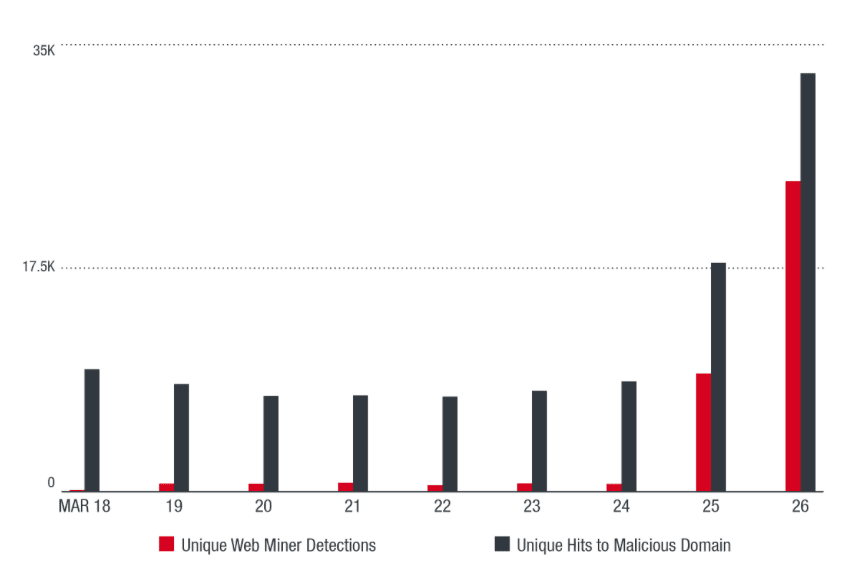

The firm, Trend Micro reported a 108% increase in unique web mining from March 24 to March 25 of 2018 on ads found on MSN and AOL. The hackers redirected significant numbers of users to the domain www[.]jqcdn[.]download, as shown below.

As seen below, 500 websites were found to be compromised and a large amount of the compromised content was hosted on Amazon Web Service S3 buckets.

Previous instances of this trend include a January 2017 ad mining attempt to mine Monero cryptocurrency through CoinHive javascript code.

In light of this heightened activity, users are encouraged to use minerBlock and No Coin extensions on the Chrome web store to preempt this indirect mining.

First Global Report Ranks Nation-Preparedness for Cloud Computing Services, Providing Important Investor Information

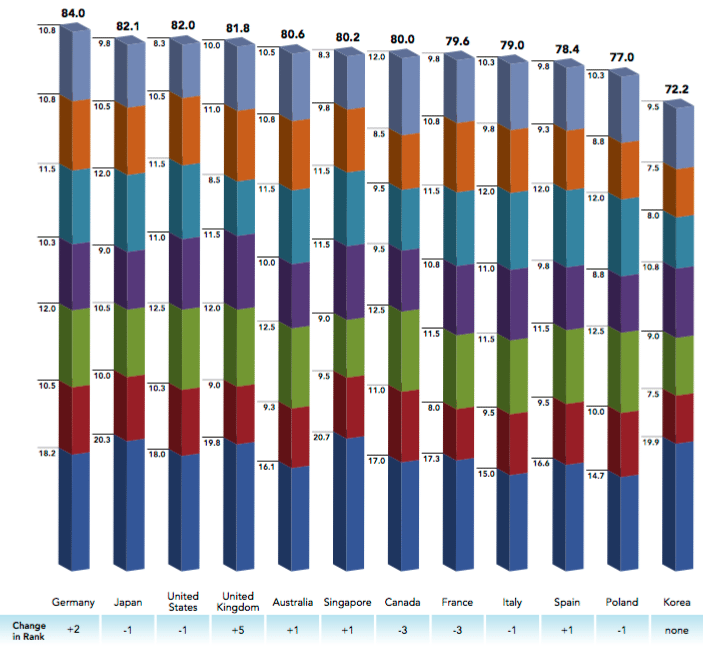

The 2018 BSA Global Cloud Computing Scorecard—the only global report to rank countries’ preparedness for the adoption and growth of cloud computing services, recently upgraded its method of data collection to factor in policy areas, privacy laws, cybersecurity law, and broadband infrastructure into its scorecard of rank for nations worldwide.

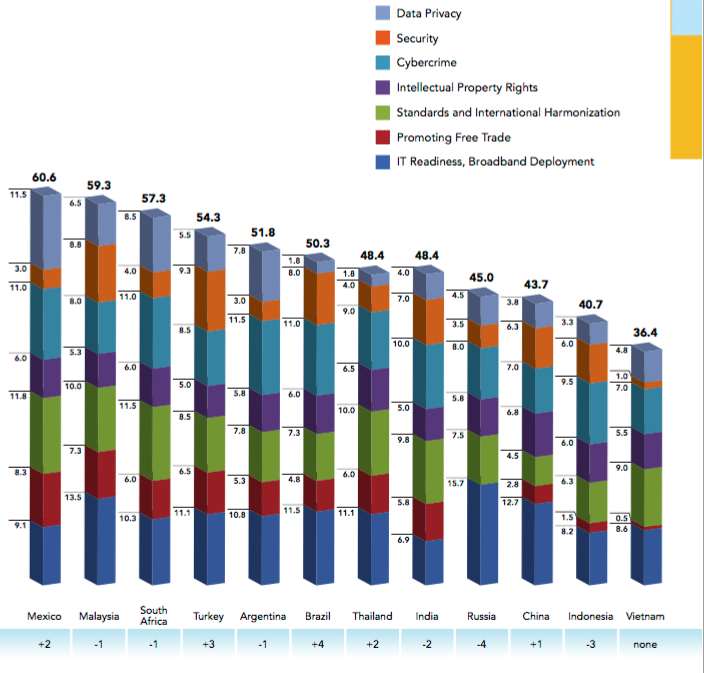

The scorecard below examines the regulatory and legal framework of 24 countries, including China, Brazil, Russia, Singapore, and Mexico.

Highlights from the scorecard:

Canada and Mexico score highest in the privacy section, providing comprehensive privacy regimens without onerous registration requirements.

Brazil and Thailand, which largely lack such laws, score poorly in the privacy section.

In the security section, the UK, Germany, France, Australia, Japan, and the US score the highest, whereas Mexico, Argentina, and Vietnam score the lowest especially due to a slowed implementation of national cybersecurity strategies.

The full graphic from the report can be seen below, demonstrating the preferred positioning of Mexico, Malaysia, and South Africa, especially in categories of IT Readiness.

Trans Saharan Gas Pipeline Set to Become Globe’s Largest Pipeline

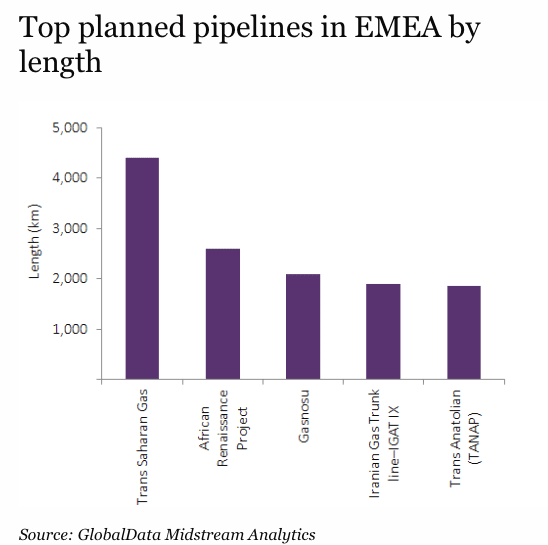

According to Global Data’s latest report of pipeline planning underway in the region of Europe, the Middle East, and Africa (EMEA)—between 2018 and 2022—the Trans Saharan Gas project pipeline will become the longest planned pipeline at 4,400 km.

Key stakeholders in the pipeline are the Nigerian National Petroleum Corporation with a 45% stake, Republic of Niger with a 10% stake and Sonatrach SPA with a 45% stake.

The second largest pipeline will be the African Renaissance Project, beginning in Mozambique with a total length of 2,600 km. Stakeholders in the project are China National Petroleum Corporation at 20%, Profin Consulting Sociedade Anonima at 28% and Empresa Nacional de Hidrocarbonetos EP at 28%.

A graphic from GlobalData Midstream Analytics is presented below ranking the project in the upcoming 5 years in the EMEA region, with the famed TANAP ranking 5th.

The longest pipeline, in Nigeria, has been delayed, and investors are in discussions with the main player in the deal, Nigeria, which is in the midst of difficulties in meeting its gas obligation to neighboring African countries as a result of insecurity in the Niger Delta.

The pipeline will be key for investors interested in the space of bringing Nigerian gas to the Mediterranean through Niger and Algeria.

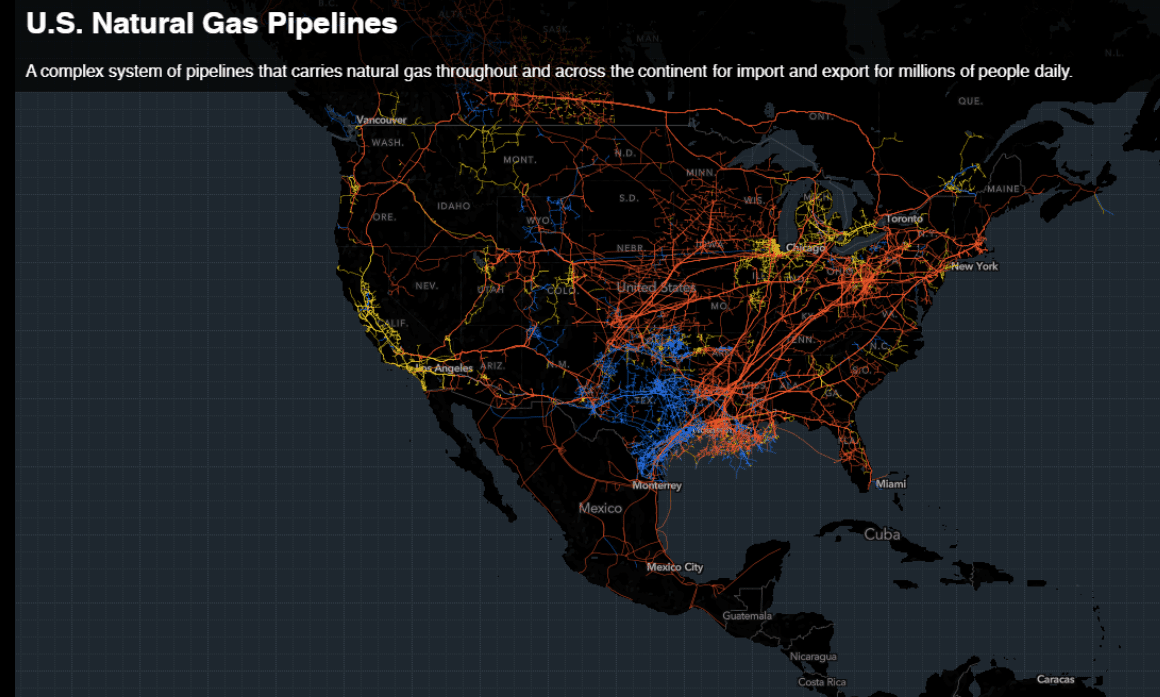

Recent US Attack Demonstrates Even Pipeline Industry Not Immune to Cyberattacks

This week, pipeline industry giants Oneok, Energy Transfer Partners, Boardwalk Pipeline Partners, and Eastern Shore Natural Gas were all hit by a shared data cyberattack. All the operators shut down computer operations as a result of the attack.

The event represents how vulnerable even national energy infrastructure systems can be to malicious cyber activities.

The suspect of the attack has not been noted by the Department of Homeland Security, although as the New York Times reported, the event took place just following the FBI’s announcement about an alleged Russian attempt to target the US electric grid and other infrastructure systems.

The below Bloomberg graphic shows the intricate pipeline system in the US which carries natural gas throughout and across the continent.

The event, along with previous minor attacks on oil pipelines in the US, has called attention to the growing industry of Cyber Security for oil pipelines.

LIMA CHARLIE NEWS

[Edited by Nikita Roach]

Lima Charlie provides global news, insight & analysis by military veterans and service members Worldwide.

For up-to-date news, please follow us on twitter at @LimaCharlieNews

In case you missed it:

![Image This Week in Business Intelligence [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/03/This-Week-in-Business-Intelligence-Lima-Charlie-Business-Intel-Report.png)

![Iranian crackdown on MEK shows the activist group has popular support [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/05/Iran-MEK-Lima-Charlie-001-480x384.png)

![The Mind of Bolton - AUMF and the New Iran War [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/05/Inside-the-mind-of-Bolton-Lima-Charlie-News-main-01-480x384.png)

![Image War in Eastern Ukraine and the New Heroes of ‘Novorossiya’ (New Russia) [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/04/Donbass-MAIN-01-480x384.png)

![Image Memorial Day may soon be a remembrance of democracy and those who had the courage to defend it [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/05/Memorial-Day-may-soon-be-a-remembrance-of-democracy-and-those-who-had-the-courage-to-defend-it-Lima-Charlie-News-480x384.png)

![Iranian crackdown on MEK shows the activist group has popular support [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/05/Iran-MEK-Lima-Charlie-001-150x100.png)

![The Mind of Bolton - AUMF and the New Iran War [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/05/Inside-the-mind-of-Bolton-Lima-Charlie-News-main-01-150x100.png)