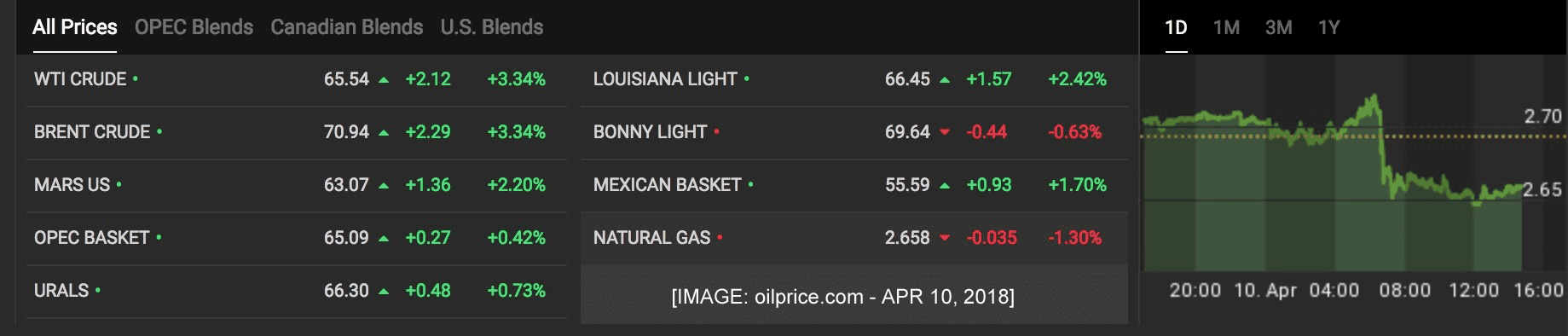

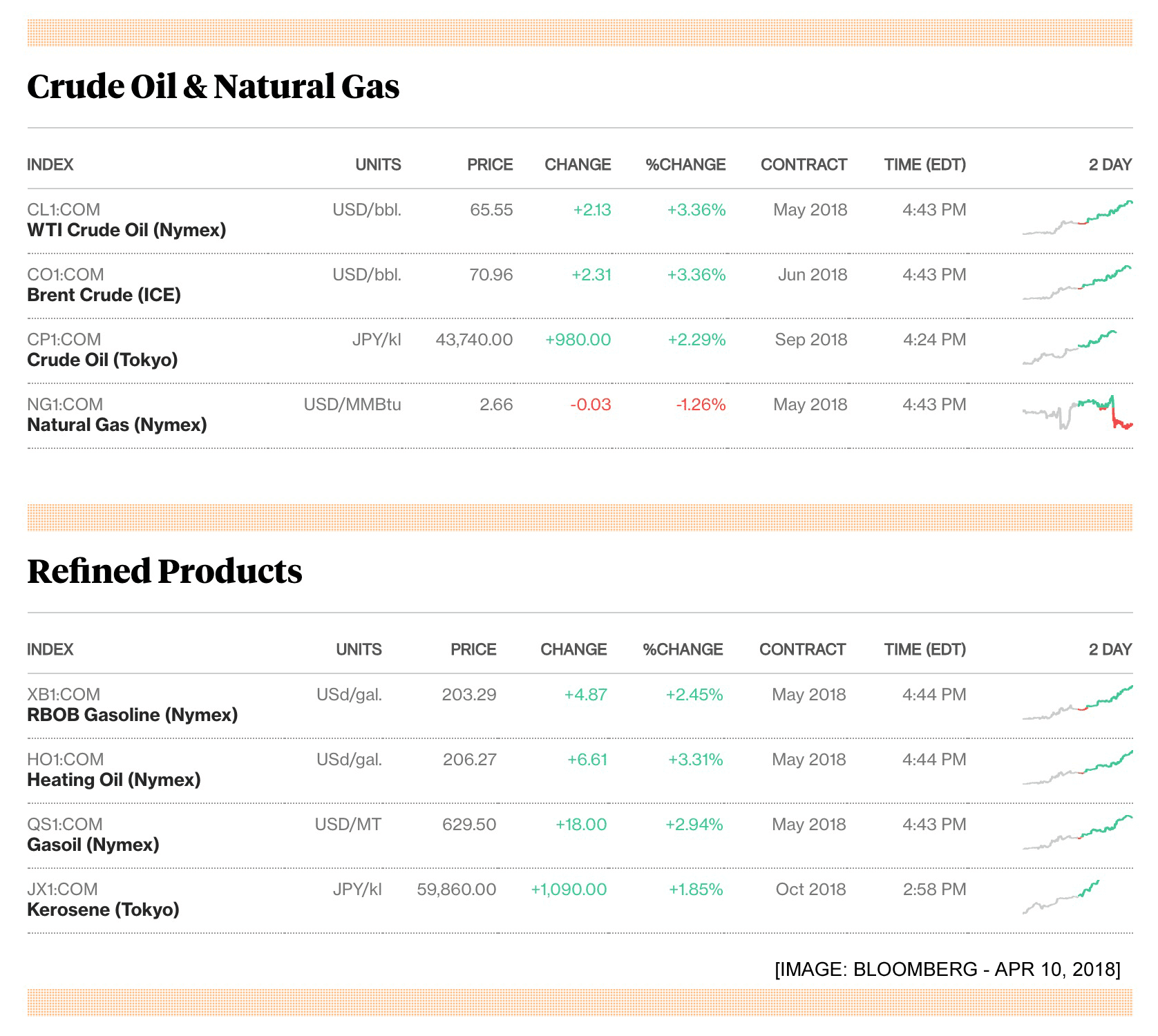

North Sea Oil Brent has recently been trading at over $70 per barrel, indicating a valuation rise of almost 30% in less than a year.

In recent years, the battle for the oil market has been fought between the 14 OPEC member states and Russia ostensibly on one side, and the US shale oil producers on the other. Between 2014 and 2016 the Saudi Arab oil industry, a member of OPEC, attempted to break the status quo and began contributing to an oversupply that saw oil prices plummet from over $110 dollars per barrel, to under $30. The worldwide oil industry was thrown into disarray. By 2016 the Saudis had to stabilize their oil production, which was seeing freefall profit margin losses and quickly decimating the country’s financial reserves.

Since then, OPEC has agreed to keep a limited production tempo, leading to the overall oil price indexes to rise nearly 30% in 2018. In other words, the industry is halfway there to recover its 2013 price per barrel.

It is however, not just the newly found OPEC discipline that has given cause to this recovery. A general global economic recovery has also seen an overall increase in oil consumption, production and transportation.

But the future is not all bright. The Venezuelan economic crisis has undermined the stability of the South American oil industry. And then there’s Donald Trump.

Since the US and other Western countries lifted sanctions against Iran in January 2016, Iran quickly sought to regain its position as one of the world’s largest oil producers. But concerns about the reintroduction of Iranian trade sanctions have increased since President Trump appointed John Bolton as his new National Security Adviser, replacing Lieutenant General H.R. McMaster. The removal of Rex Tillerson, an old hand in the oil industry game, in favor of Mike Pompeo as Secretary of State has also caused further concern. Both Bolton and Pompeo are known “Iran hawks” and are largely absolutists in their beliefs regarding the oil producing Middle East. This shift in dichotomy and political discourse causes concern in an industry that constantly seeks stability amidst its profitability.

3Q 4Q Outlook

As oil prices continue to climb, transportation costs will continue to increase, which will bring a likely rise in inflation by summer. This in turn would cause oil prices to stagnate. On the upside, thanks to the rebound in oil revenues from the lows of just over two years ago, the US domestic oil industry is not likely to be hit as fiercely as in 2014. However both Saudi Arabia and Russia are dependent on the current level of oil revenues continuing to rise.

Saudi Arabia will no doubt be hit the worst, as it is currently undergoing a reshaping of its infrastructure and overall industries. The country is seeking to move away from its oil dependent revenue streams, but is far from ready to do so at this stage. Saudi Crown Prince Mohammed bin Salman has announced a series of economic and society reforms, combined with an enormous investment scheme, to accomplish this mission. Yet Saudi Arabia will need enormous amounts of resources to succeed. These resources will primarily come from financial reserves, and from oil revenue streams.

Non-OPEC supply in 1H18 is forecast to average 59.32 mb/d, up by 1.23 mb/d from 2H17 and higher by 1.67 mb/d over 1H17. While 2H18 forecast is higher by 0.42 mb/d than 1H18, averaging 59.74 mb/d. #OPEC #MOMR pic.twitter.com/cpL8PDhh6r

— OPEC (@OPECSecretariat) April 3, 2018

Another contributing factor is the seasonal pattern of oil consumption. Oil prices tend to climb through spring and summer, when more consumers go on car holidays, only to see slow downs in the fall. The current price points are also seeing oil stockpile holders, such as government and transport companies, replenish their oil depots. The current increasing consumption of oil, is in other words not likely to hold for much longer. With this in mind, the industry is largely preparing to have to settle for price points around $75 to $78 dollars per barrel.

This, combined with aggressive Trump administration policies towards oil producing countries, such as Iran, may lead to instability in the industry, and ultimately dampen growth as inflation rises.

John Sjoholm, LIMA CHARLIE NEWS

John Sjoholm is Lima Charlie’s Middle East Bureau Chief, Managing Editor, and founder of the consulting firm Erudite Group. A seasoned expert on Middle East and North Africa matters, he has a background in security contracting and has served as a geopolitical advisor to regional leaders. He was educated in religion and languages in Sana’a, Yemen, and Cairo, Egypt, and has lived in the region since 2005, contributing to numerous Western-supported stabilisation projects. He currently resides in Jordan. Follow John on Twitter @JohnSjoholmLC

Lima Charlie World provides global news, featuring insight & analysis by military veterans, intelligence professionals and foreign policy experts Worldwide.

For up-to-date news, please follow us on twitter at @LimaCharlieNews

In case you missed it:

![Image Oil Industry Faces Problems Ahead [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/04/Oil-Industry-Faces-Problems-Ahead.jpg)

![Image Drop in oil prices may trigger unintended consequences [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/11/main_900-480x384.jpg)

![Image Texas Oil Boom Causes Headaches [Lima Charlie News][Photo: Marie D. De Jesus]](https://limacharlienews.com/wp-content/uploads/2018/07/Texas-Oil-Boom-Causes-Headaches-480x384.jpg)

![Image Saudis push OPEC, Russia to raise oil prices [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/04/Saudis-push-OPEC-Russia-to-raise-oil-prices-480x384.png)

![Africa’s Elections | In Malawi, food, land, corruption dominate [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/06/Malawi-election-Food-land-corruption-480x384.jpg)

![Syria’s oil, gas and water - the Immiscible Solution to the War in Syria [Lima Charlie News][Photo: ANDREE KAISER / MCT]](https://limacharlienews.com/wp-content/uploads/2019/05/Syria’s-oil-gas-and-water-480x384.png)

![Image The Rwandan Jewel - Peacekeepers, Conflict Minerals and Lots of Foreign Aid [Lima Charlie World]](https://limacharlienews.com/wp-content/uploads/2019/03/Rwanda-Jewel-480x384.jpg)

![Image Russia's energy divides Europe [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/03/Russias-energy-divides-Europe-Lima-Charlie-News-480x384.png)

![Image Drop in oil prices may trigger unintended consequences [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/11/main_900-150x100.jpg)

![Image Texas Oil Boom Causes Headaches [Lima Charlie News][Photo: Marie D. De Jesus]](https://limacharlienews.com/wp-content/uploads/2018/07/Texas-Oil-Boom-Causes-Headaches-150x100.jpg)