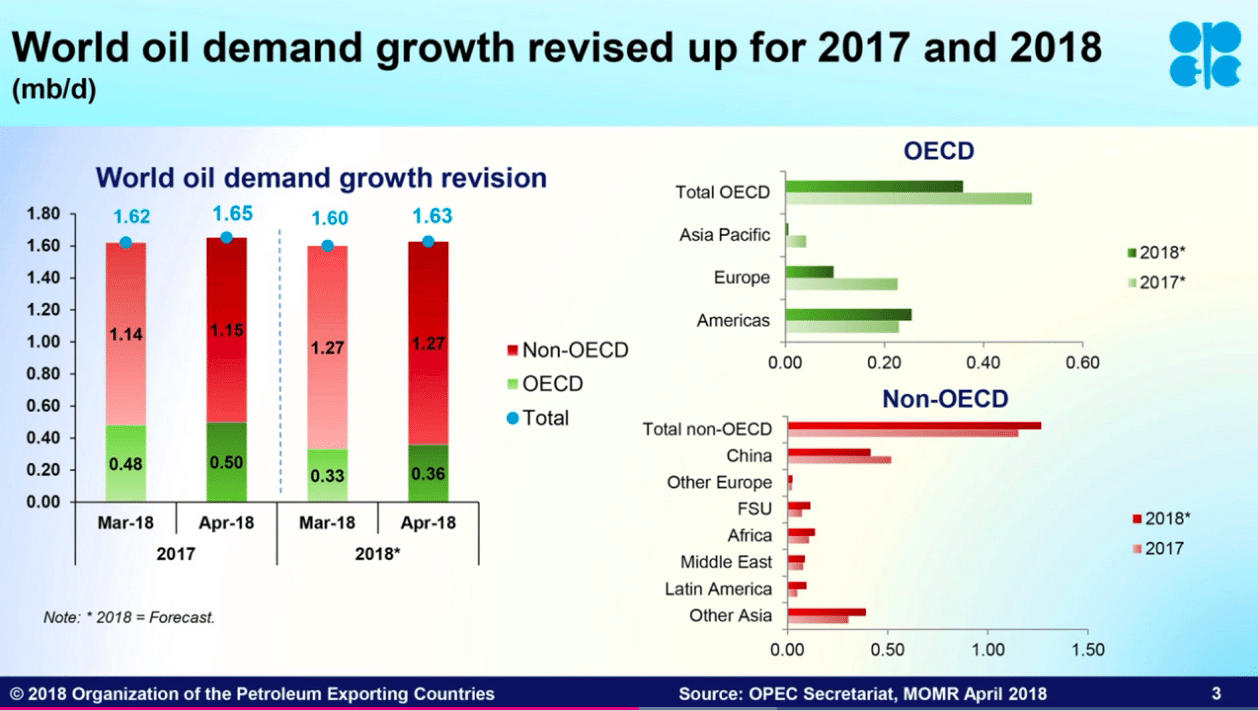

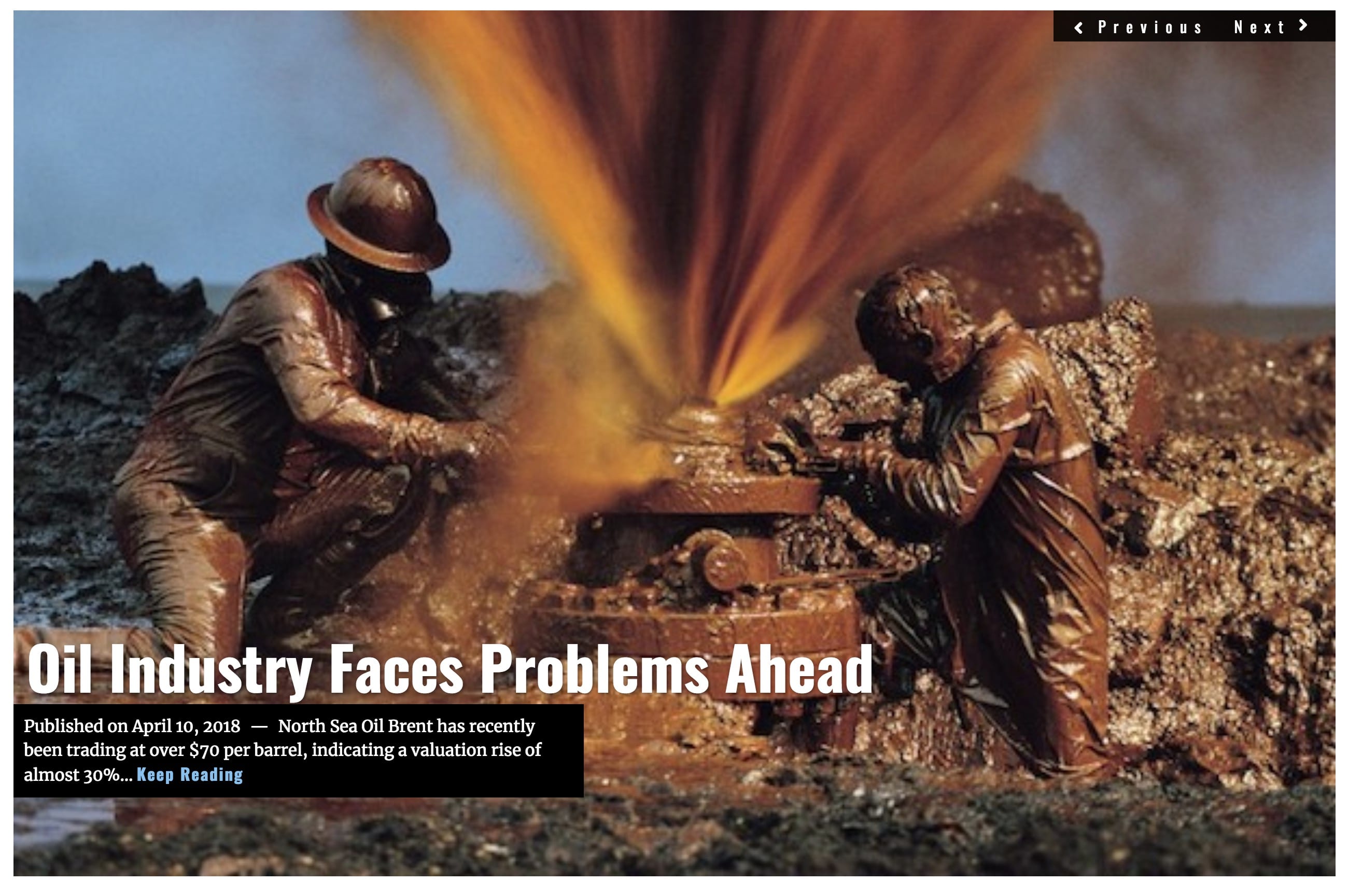

Oil prices have continued to surge, setting new records, after multiple indicators that Saudi Arabia wants to push prices to $100 per barrel in the coming months. This in turn could lead to a new crisis on the fragile worldwide energy market.

Having learned a valuable lesson from its 2014-2016 trade war, Saudi Arabia has teamed up with a former foe, Russia, to control the future of the oil world.

In January 2017, the Saudi led OPEC signed an agreement with Russia to better control the tempo of oil production. The alliance agreement quickly proved agreeable and profitable, and was extended on in January 2018 to January 2019.

OPEC and Russia are the largest participants in the volatile crude oil production market, and together they represent a majority of worldwide oil production. In effect, the market alliance allows Saudi Arabia and Russia to control the flow of oil worldwide, and with it the market prices. Now, the two power blocks are looking at extending the agreement yet again, but this time making it a 10 to 20 year alliance.

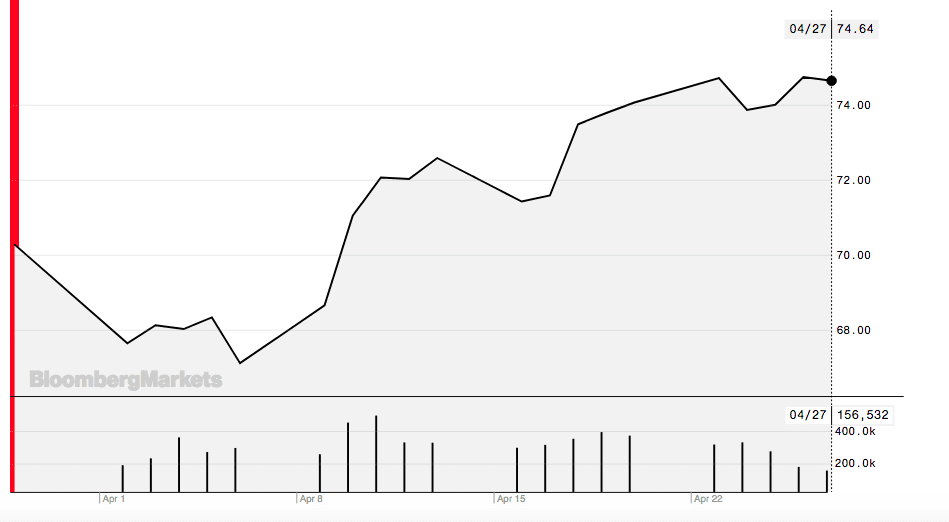

On April 20th OPEC, with its 14 member countries, met with Russia and other allies in Jeddah to discuss a new market strategy. The strong attendance at the meeting is believed to indicate the seriousness of what is being discussed, and how recent geopolitical troubles concern members of the group.

![Image [OPEC Oil Market Report, April 2018]](https://limacharlienews.com/wp-content/uploads/2018/04/Screen-Shot-2018-04-29-at-2.05.50-PM.png)

“Producers need to send signals that the agreement should continue,” said Jonathan Goldberg, chief investor in the hedge fund BBL Commodities.

The agreement that OPEC and Russia now have sets out to reduce industrial countries’ oil stocks to a five-year average, which would prolong the viability of existing oil wells as well as control the market levels.

In light of this successful market alliance of six out of ten top-10 oil producers, Saudi Arabia now appears intent on further controlling the market output, to force oil prices to over $100 per barrel. With the exception of Iran, all OPEC membership countries appear willing to reduce their oil output to cause a controlled price surge.

Russia has been seen as being unwilling to follow suit. Instead, Russia has appeared to be aiming at keeping prices between 50 and 55 dollars per barrel. This would be enough, for Russia, to balance its budget, yet provide a healthy surplus, this according to the Moscow-based commodities trader Renaissance Capital.

However, recent market turbulence, largely attributed to recent sanctions against Russian industries, might lead to shortfalls in projected GDP developments for the country and are seen as having forced Russia to go along with the Saudi proposal. Arguably Russia is in even greater need of a stabilized, at a high level, oil price due to its shaky economy and the ongoing international sanctions against the country.

![Image [Image: Bas van der Schot - Twitter @bvdschot]](https://limacharlienews.com/wp-content/uploads/2018/04/Bas-van-der-Schot-Saudi-Russia.jpg)

The rumor of Riyadh’s intent caused a spike in Brent crude pricing, rising it to nearly 75 dollars a barrel, the highest level it has been at since the end of 2014. Prices have fluctuated slightly, but remain at about 74-75 dollars a barrel.

The ARAMCO IPO has been widely associated with the reformist ambitions of Crown Prince Mohammed bin Salman, and is estimated to bring in $100 billion dollars. If the IPO failed, it would not just be a devastating personal blow towards the crown prince, but could also damage the ambitions of the reformist movement inside the Kingdom.

Today, ARAMCO announced the addition of five new members to its Board of Directors, adding its first-ever female director, Lynn Laverty Elsenhans, former Chairwoman, President and CEO, of Sunoco Inc. and former executive VP of global manufacturing for Royal Dutch Shell. The move is arguably in preparation for the IPO.

Nasser: While our deep-rooted history has provided us with strong foundations for organizational structure, process, and guidelines, we have also been guided by international practices.https://t.co/SiPW7QgvSe pic.twitter.com/2B6T3ebruB

— aramco | أرامكو (@Saudi_Aramco) April 25, 2018

For awhile, ARAMCO is considered to be the world’s most valuable company, it is also highly sensitive to market fluctuations. The 2016 $2 trillion dollar valuation ARAMCO was largely based on the now largely drained oil reserves of 266 million barrels. To reach the $2 trillion valuation, ARAMCO estimated the value of the 266 billion barrels in reserve multiplied by the market price. The market price that ARAMCO chose to utilize was, in part, the price that French competitor Total S/A valued their Danish competitor Maersk Oil in 2016 during a takeover bid. In 2017, Total bought Maersk for $7.45 billion dollars in a combined share and debt transaction.

However, since then the commodities market prices have been in flux. This has made a 2018 IPO of ARAMCO a significantly less reliable investment, and likely to not bring in the needed $100 billions dollars. This is largely the primary attributed cause, as the Saudi’s themselves are notoriously quiet on the matter, to postpone the IPO until 2019 or even 2020. Some analysts also believe that another reason is that the Saudis know that if they can cause a market price surge on oil, it may be able to refill its financial reserves without having to sell stocks in the company at all.

If this combination of factors comes to play out as expected, it could severely disrupt the fragile energy market. This in turn would cause a downturn in the American trucking and export industry, strengthen Chinese oil production reliance, and cause Europe to become further dependent on natural gas from Russia and the east bloc. It would also cause the US shale oil producers to try to match market demands, which could have devastating consequences to the American environment, and cause a hot button issue in the coming domestic elections.

John Sjoholm, LIMA CHARLIE NEWS

John Sjoholm is Lima Charlie’s Middle East Bureau Chief, Managing Editor, and founder of the consulting firm Erudite Group. A seasoned expert on Middle East and North Africa matters, he has a background in security contracting and has served as a geopolitical advisor to regional leaders. He was educated in religion and languages in Sana’a, Yemen, and Cairo, Egypt, and has lived in the region since 2005, contributing to numerous Western-supported stabilisation projects. He currently resides in Jordan. Follow John on Twitter @JohnSjoholmLC

Lima Charlie World provides global news, featuring insight & analysis by military veterans, intelligence professionals and foreign policy experts Worldwide.

For up-to-date news, please follow us on twitter at @LimaCharlieNews

In case you missed it:

![Image Saudis push OPEC, Russia to raise oil prices [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/04/Saudis-push-OPEC-Russia-to-raise-oil-prices.png)

![Image Drop in oil prices may trigger unintended consequences [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/11/main_900-480x384.jpg)

![Image Texas Oil Boom Causes Headaches [Lima Charlie News][Photo: Marie D. De Jesus]](https://limacharlienews.com/wp-content/uploads/2018/07/Texas-Oil-Boom-Causes-Headaches-480x384.jpg)

![Image The Week in U.S. Politics [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/03/Lima-Charlie-Week-in-Politics-01-480x384.jpg)

![Africa’s Elections | In Malawi, food, land, corruption dominate [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/06/Malawi-election-Food-land-corruption-480x384.jpg)

![Syria’s oil, gas and water - the Immiscible Solution to the War in Syria [Lima Charlie News][Photo: ANDREE KAISER / MCT]](https://limacharlienews.com/wp-content/uploads/2019/05/Syria’s-oil-gas-and-water-480x384.png)

![Image The Rwandan Jewel - Peacekeepers, Conflict Minerals and Lots of Foreign Aid [Lima Charlie World]](https://limacharlienews.com/wp-content/uploads/2019/03/Rwanda-Jewel-480x384.jpg)

![Image Russia's energy divides Europe [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/03/Russias-energy-divides-Europe-Lima-Charlie-News-480x384.png)

![Image Drop in oil prices may trigger unintended consequences [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/11/main_900-150x100.jpg)

![Image Texas Oil Boom Causes Headaches [Lima Charlie News][Photo: Marie D. De Jesus]](https://limacharlienews.com/wp-content/uploads/2018/07/Texas-Oil-Boom-Causes-Headaches-150x100.jpg)