After an intense month that saw aluminium prices surge by 25 percent, the market has begun to settle. This after the U.S. indicated it would ease sanctions against Russian aluminium giant United Co. Rusal.

Commodity traders often say that the commodities market has a life of its own. This became even more apparent during the weeks of April 3rd to April 22nd when aluminium commodities surged 25 percent to a high of over 2,600 US dollars per ton.

The surge came as a direct result of the April 6th announcement that the US government would level sanctions against the Russian President Vladimir Putin-affiliated oligarch, Oleg Deripaska. Deripaska is a majority stakeholder in United Co. Rusal, a company that represents nearly 9% of the world’s primary aluminium output. Deripaska had announced back in February that he would step down as president of Rusal.

In total, seven Russian oligarchs, 12 companies they own or control, 17 senior Russian government officials, and a state-owned Russian weapons trading company and its subsidiary, a Russian bank were subjected to sanctions.

The April 6th statement was followed by indicators that the US Department of the Treasury might seek to impose further sanctions against Rusal and its owner.

Fearing that such sanctions could disrupt not just the world aluminium market, but also the Russian economy, the markets responded.

In the coming days the sanctions caused the delisting of the Kubal smelter in Sundsvall, Sweden, by Nord Pool, the largest market for electrical energy and commodities in Europe, on April 18th. The smelter is wholly owned and operated by Rusal and is its primary metal production facility outside of Russia. It equals 3% of Rusal’s production, or 123,000 tonnes of metal per year.

The delisting disrupted Kubal’s production, causing it to be unable to supply aluminium for over two weeks. Given that Rusal is the world’s largest aluminium producer, accounting for 27 percent of shipments to Europe, a reduction in available material would have severe consequences to the overall marketplace.

Last week, at Russia’s request, U.S. Treasury Secretary Steven Mnuchin met with Russian Finance Minister Anton Siluanov during International Monetary Fund meetings in Washington. According to Mnuchin, the Russians had “clarification” questions about the U.S. sanctions. Siluanov had been making his case as well throughout Russian and Western media.

Министр финансов Антон #Силуанов в интервью @RT_russian: Правительство будет оказывать поддержку предприятиям, попавшим под санкции https://t.co/g7f0YVJWoT

— Минфин России (@ru_minfin) April 20, 2018

By Monday, the U.S. Treasury announced that it would issue a general license “to mitigate” the impact on parties affected by the Deripaska sanction designation. According to a Treasury release: “RUSAL has felt the impact of U.S. sanctions because of its entanglement with Oleg Deripaska, but the U.S. government is not targeting the hardworking people who depend on RUSAL and its subsidiaries,” said Treasury Secretary Steven T. Mnuchin. “RUSAL has approached us to petition for delisting. Given the impact on our partners and allies, we are issuing a general license extending the maintenance and wind-down period while we consider RUSAL’s petition.”

https://twitter.com/USTreasury/status/988404708686655488

The market response was instant. By Monday afternoon, aluminium prices had turned sharply, falling by 10 percent.

On Tuesday, Russian Minister of Industry and Trade Denis Manturov said that he would not rule out the possibility that the state buys a stake in Rusal from Deripaska, according to Russia news agency Interfax. On Wednesday, Deputy Prime Minister Arkady Dvorkovich, in response to a question as to whether the state plans to nationalize companies that were under sanctions, said that nobody had applied to the government with such a request.

Aluminium is an essential input for many industries, particularly the automotive sector and the construction industry. While some aluminium market fluctuations are expected and prepared for, the manufacturing market segments were, however, not prepared for between 15 to 25 percent increases in material costs. Usually, companies pass on price increases in the aluminium to customers, but that can only be done up to a certain point.

The significant fluctuations and uncertainty during April are expected to have long-term consequences and might cause aluminium market growth to decrease. The notion that geopolitical considerations might leave companies exposed, left without the ability to manufacture their products, caused many to buy large quantities at high prices before Monday’s statement.

The effect of this will no doubt be reflected in the upcoming quarterly and half-year reports, which will cause further disruptions on the market and affect future earnings prognoses for many companies.

John Sjoholm, LIMA CHARLIE NEWS

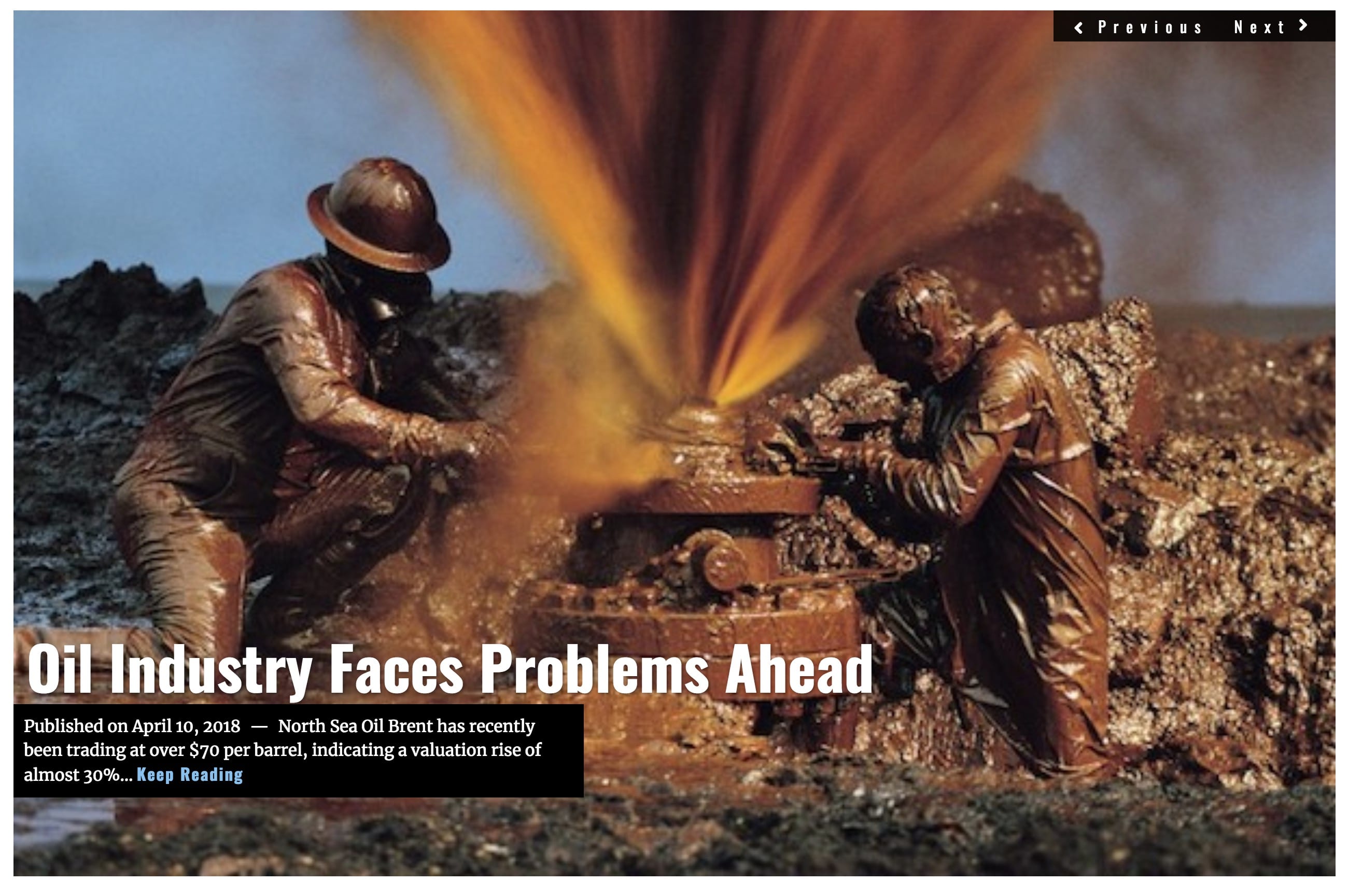

[Main image: James Fox]

For up-to-date news, please follow us on twitter at @LimaCharlieNews

In case you missed it:

![Image Aluminium prices settle after U.S. eases Russia sanctions for aluminium giant Rusal [Lima Charlie News][Image: James Fox]](https://limacharlienews.com/wp-content/uploads/2018/04/Aluminium-prices-settle-after-U.S.-eases-Russia-sanctions-for-aluminium-giant-Rusal.png)

![Image Russia's energy divides Europe [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/03/Russias-energy-divides-Europe-Lima-Charlie-News-480x384.png)

![Image Russian aluminium giant Rusal’s woes continue, but with a short reprieve [Lima Charlie News][Image: James Fox]](https://limacharlienews.com/wp-content/uploads/2018/05/bleh-480x384.png)

![Image 'Sanctions and the Rise of Putin's Russia' - starring oligarchs, siloviki, Rossiyskaya mafiya and Oleg Deripaska [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/04/Putin-oligarchs-Lima-Charlie-News-480x384.png)

![Image Memorial Day may soon be a remembrance of democracy and those who had the courage to defend it [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/05/Memorial-Day-may-soon-be-a-remembrance-of-democracy-and-those-who-had-the-courage-to-defend-it-Lima-Charlie-News-480x384.png)

![The Mind of Bolton - AUMF and the New Iran War [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/05/Inside-the-mind-of-Bolton-Lima-Charlie-News-main-01-480x384.png)

![Image Russia's energy divides Europe [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/03/Russias-energy-divides-Europe-Lima-Charlie-News-150x102.png)

![Image Russian aluminium giant Rusal’s woes continue, but with a short reprieve [Lima Charlie News][Image: James Fox]](https://limacharlienews.com/wp-content/uploads/2018/05/bleh-150x100.png)