Power moves first. Law follows. Narratives arrive last.

It is rarely useful to comment on events while they are still unfolding. Early narratives are noisy and moralising, designed more to allocate virtue than to explain causality. Still, such moments can be diagnostically useful. They reveal how quickly observers default to legal and moral language when confronted with the exercise of power.

Venezuela is already being framed in familiar terms: sovereignty violated or restored, democracy defended or undermined, international law upheld or breached. These descriptions are not incorrect. They are simply downstream. They belong to the justificatory layer that follows action, not the operating logic that produces it. When systems come under strain, they do not begin by defending norms. They begin by defending settlement.

As noted previously, “Survival in international politics is often granted not by strength, but by disinterest. People are not spared because they matter, but because they do not.” For years, Venezuela benefited from irrelevance. For the current U.S. administration’s purposes, that condition ceased to apply.

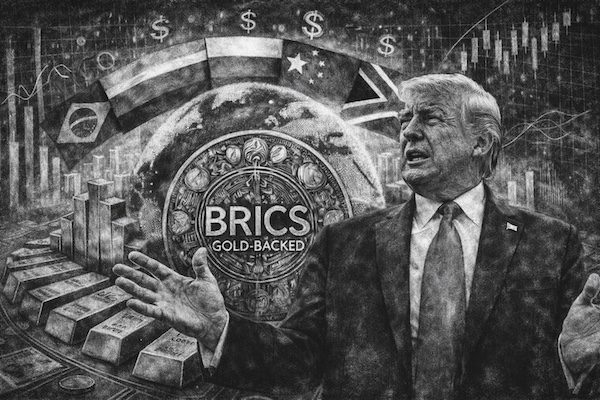

For roughly half a century, the dollar-based order has rested on a functional sequence rather than a moral one. Energy is priced in dollars. Trade settles in dollars. Reserves are held in dollars. Security guarantees underpin the loop. This arrangement never depended on universal consent. It worked because it aligned convenience, coercion, and capacity. Financial instruments reduced the need for overt force, but force remained implicit, available, and decisive when required.

Venezuela did not become problematic because it was authoritarian, corrupt, or illegitimate. It had been all three for years without provoking decisive action. The problem emerged when strategic resources began drifting outside dollar settlement while simultaneously moving beyond U.S.-aligned security structures. Oil traded outside the dollar is tolerable at the margins. Oil traded outside the dollar, combined with political defiance and external alignment, is not. At that point, governance ceased to be the issue. Architecture became the issue.

At that point, Maduro ceased to be ignorable.

From there, the sequence followed a familiar pattern. Financial isolation first, framed as sanctions and compliance enforcement. Progressive economic constriction second, justified as pressure for reform. Political delegitimation followed, amplified through diplomatic and informational channels. Only at the final stage did direct removal become an option. The order matters. Legitimacy did not justify enforcement. Enforcement generated a post-hoc legitimacy narrative.

This pattern is neither new nor exceptional. Gaddafi’s attempt to construct a pan-African currency outside the dollar system followed a similar trajectory. Iraq’s move toward euro-denominated oil sales preceded its destruction. These cases are often debated in moral or conspiratorial terms, but the mechanism itself is unremarkable. Attempts to reconfigure settlement systems without corresponding security alignment invite correction.

The point is not hidden intent but structural incentive; systems respond to threats in consistent, impersonal ways that are often misread as conspiratorial.

Correction does not require consensus. It requires capacity.

Much of the current discourse around “de-dollarisation”, particularly within BRICS rhetoric, obscures this distinction. What is unfolding is not coordinated rebellion but broad hedging behaviour. States diversify reserves, reduce exposure, and experiment with alternative rails. Japan’s recent bond rebalancing fits squarely within this logic. It reflects asset management rather than strategic defection. The signal is caution, not rupture.

Venezuela did not become problematic because it was authoritarian, corrupt, or illegitimate. It had been all three for years without provoking decisive action.

China understands this dynamic with notable clarity. Its approach remains incremental and deliberately non-confrontational. Parallel systems are built quietly. Redundancy is layered beneath existing structures. Exposure is reduced without forcing a decisive break. CIPS, mBridge, and bilateral settlement mechanisms function as insurance rather than declarations. They are designed to operate until enforcement costs rise to a level that can no longer be ignored.

Beijing will avoid open rupture for as long as enforcement remains affordable for Washington. Not out of deference, but calculation. The objective is not to defeat the system prematurely, but to ensure survivability once coercion becomes too expensive to sustain. Subtlety persists until it no longer pays.

Cryptocurrency does not materially alter this trajectory. It accelerates fragmentation rhetorically while remaining strategically insufficient as a foundation for order. Volatility cannot anchor sovereignty. Decentralisation cannot substitute for enforcement. Crypto complicates incumbents but does not replace them.

What ties these developments together is hierarchy rather than ideology. Trump, Xi, and Putin differ markedly in temperament, domestic constraint, and political presentation, yet converge operationally. Order follows power, not rules. Trade follows protection. Currency follows power. Institutions adjust after the fact.

The arrest of Maduro should be read in this context. Not as a legal act, nor as a moral one, but as a reminder that settlement systems remain subordinate to security arrangements. Deviation is tolerated only where it does not threaten the hierarchy that sustains them. When it does, correction follows, irrespective of procedural discomfort.

This does not signal the imminent collapse of the dollar order, nor does it guarantee its permanence. It indicates something narrower and more revealing: enforcement is becoming more visible because quieter mechanisms are being tested. The effort required to preserve the existing order is increasing, and visibility rises as friction grows.

Systems do not fail because they are criticised. They fail when enforcement becomes too costly to perform. We are not there yet. But the direction of travel is no longer theoretical.

What they are watching is not Venezuela, but the price of order – and the cost of enforcing it.

John Sjoholm, for LIMA CHARLIE WORLD

[Subscribe to our newsletter for free and be the first to get Lima Charlie World updates delivered right to your inbox.]

John Sjoholm is Lima Charlie’s Middle East Bureau Chief, Managing Editor, and founder of the consulting firm Erudite Group. A seasoned expert on the Middle East, North Africa, Europe and the Balkans, he has a background in security contracting and has served as a geopolitical advisor to regional leaders. He was educated in religion and languages in Sana’a, Yemen, and Cairo, Egypt, and has lived in the region since 2005, contributing to numerous Western-supported stabilisation projects. He currently resides in Jordan.

Lima Charlie World provides global news, featuring insight & analysis by military veterans, intelligence professionals and foreign policy experts Worldwide.

For up-to-date news, please follow us on twitter at @LimaCharlieNews

In case you missed it:

![Africa’s Elections | In Malawi, food, land, corruption dominate [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/06/Malawi-election-Food-land-corruption-480x384.jpg)

![Image What’s ailing South Korea? [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/01/What’s-ailing-South-Korea-Lima-Charlie-News-480x384.png)

![Image Fed announcement triggers best trading session in over eight months [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/11/Jerome-Powell-Reuters-480x384.jpg)

![image Resistance mounts against China's President Xi Jinping [Lima Charlie News][Photo: Johannes Eisele / AFP]](https://limacharlienews.com/wp-content/uploads/2018/08/Resistance-mounts-against-Chinas-President-Xi-Jinping-480x384.jpg)