In spite of increasing oil production, U.S. oil businesses are struggling due to lack of infrastructure and uncertain international conditions.

2018 was the year US domestic oil production was supposed to hit its true stride. It was thought a high domestic output would stabilize a fragile and volatile market, and take consumer prices to agreeable levels.

Instead, infrastructure problems caused by dramatically increased production have further destabilized the market. Price fluctuation problems have been further compounded by the fact that President Trump appears quite willing to risk further destabilizing the market by asking OPEC to increase its production.

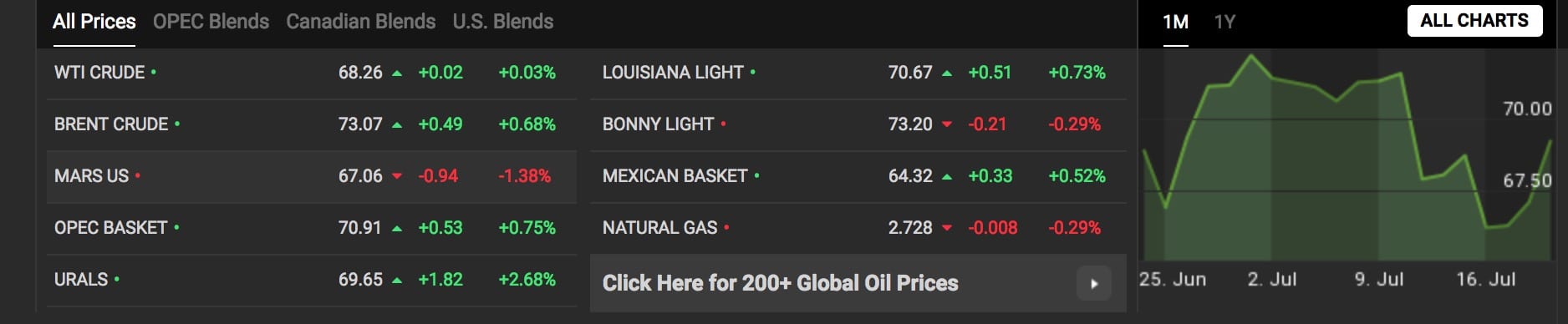

The US benchmark in oil pricing, the US West Texas Intermediate (WTI) crude oil, or Texas light sweet, reached a spot price of over $75 per barrel two weeks ago, a high not previously seen since 2014, only to drop this week to $68 per barrel. The North Sea Oil Brent Crude commodities index also saw a surge, and traded at between $77 to $79 per barrel, before dropping to $73 per barrel.

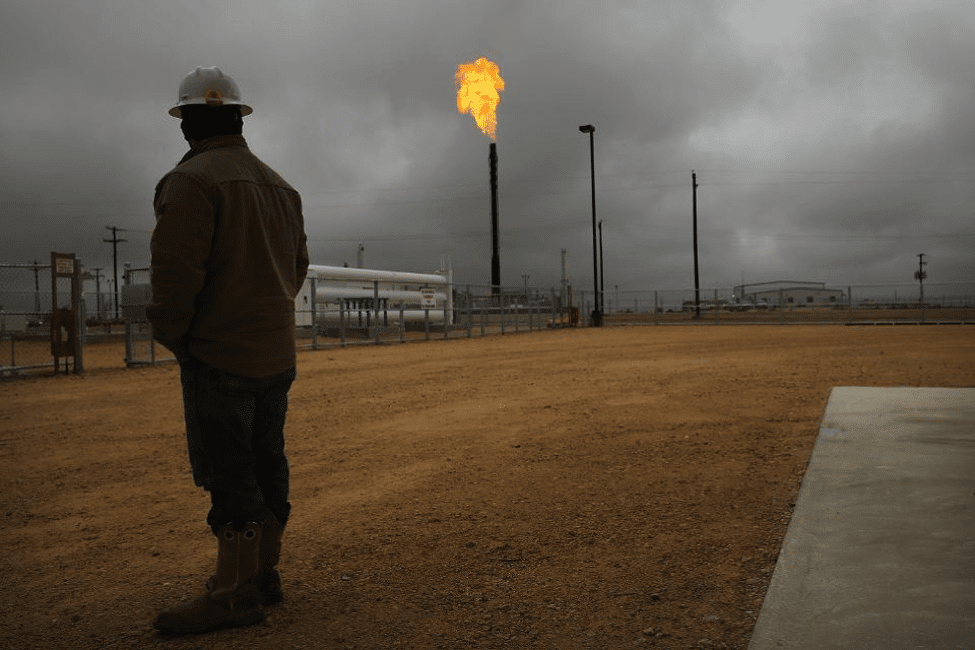

The existing infrastructure is simply not built for this level of output, with pipelines clogging up and in need of expansions. Despite this reality, pipeline constructions are barely keeping up. At the present rate, all 2018 expansions will be outpaced by the projected output by the end of 2018.

Despite the dire need for further expansions on infrastructure, Magellan Midstream Partners, one of the largest domestic infrastructure investors, canceled plans for an oil pipeline capable of transporting 350,000 barrels a day back in May.

In no small part, Magellan’s decision echos lessons learned during the last oil boom, which had a devastating affect on the market after the Kingdom of Saudi Arabia engaged its vast financial and oil resources in an oil war against the US oil industry between 2013-2016.

[Read Saudi Arabia, al Qaeda and the Salafist Dilemma]

The fear is that President Trump might invite lowering profit margins, by pushing OPEC to again overproduce, and thus lower the price to a point where the US domestic market will find it difficult to recouperate its infrastructure investments.

Oil prices are too high, OPEC is at it again. Not good!

— Donald J. Trump (@realDonaldTrump) June 13, 2018

To attempt to manage infrastructure capacity problems, the industry is shifting parts of its expansions to oil fields in East Texas. Yet this in turn has made the logistical issues more apparent, with the national shortage of truckers certified to transport oil becoming an even greater problem. In addition to the logistical problems, the expansion of operations in East Texas has doubled the number of drilled but unfinished wells this past year, reaching 2,300 unfinished wells in May.

Meanwhile, the global industry continues to be in turbulence.

Venezuelan oil production output has dropped like a proverbial stone, and temporary production problems haunt both Canada and Libya. Mexico’s recently elected president Andrés Manual Lopez Obrador has said that he will seek to revitilize Mexico’s oil industry, this to make the country independent of fuel imports within three years. Civil unrest and a violent government response is also threatening local stability and oil production in Iraq.

U.S. refinery intakes flat at 17.7 week ending Jul 6 down slightly from record 17.8 mmb/d,

Throughput was +0.41 mmb/d higher than a year ago & +0.9 mmb/d more than the 5-yr avg.#OOTT #oilandgas #oil #WTI #CrudeOil #fintwit #OPEC pic.twitter.com/NUUcM7Svis— Art Berman (@aeberman12) July 14, 2018

With this in mind, President Trump is no doubt worried how higher consumer prices at the pumps will impact the 2018 major midterm elections. To try to pre-empt this eventuality, he has called upon the Kingdom of Saudi Arabia, and OPEC to increase its production output, Saudi Arabia being one of the few large scale oil producing countries that has the capability to quickly increase its oil output.

The president’s call for increased output by OPEC goes poorly with his administration’s hard line towards Iran, which is also an OPEC member, and which produces more than 2 million barrels of oil per day. Russia is the other large scale producer that has the capability to output the necessary amounts of oil, but has a market that is significantly more fragmented, meaning that it will take several months before a new production quota can be enacted.

While the US domestic oil industry output is increasing, pipeline infrastructure investors look wearily upon President Trump’s actions. It will take until late next year before American oil producers have all the pieces necessary for stability in the domestic market. Until that point, the US industry will remain sensitive to outside market changes. This creates an additional concern that raises the price on domestic oil, and fear in investments.

Expect continued volatility in energy prices in the coming months.

[Main Photo: Marie D. De Jesus]

John Sjoholm, Lima Charlie News

John Sjoholm is Lima Charlie’s Middle East Bureau Chief, Managing Editor, and founder of the consulting firm Erudite Group. A seasoned expert on Middle East and North Africa matters, he has a background in security contracting and has served as a geopolitical advisor to regional leaders. He was educated in religion and languages in Sana’a, Yemen, and Cairo, Egypt, and has lived in the region since 2005, contributing to numerous Western-supported stabilisation projects. He currently resides in Jordan. Follow John on Twitter @JohnSjoholmLC

Lima Charlie provides global news, featuring insight & analysis by military veterans and service members Worldwide.

For up-to-date news, please follow us on twitter at @LimaCharlieNews

In case you missed it:

![Image Texas Oil Boom Causes Headaches [Lima Charlie News][Photo: Marie D. De Jesus]](https://limacharlienews.com/wp-content/uploads/2018/07/Texas-Oil-Boom-Causes-Headaches.jpg)

![Image Drop in oil prices may trigger unintended consequences [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/11/main_900-480x384.jpg)

![Image Saudis push OPEC, Russia to raise oil prices [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/04/Saudis-push-OPEC-Russia-to-raise-oil-prices-480x384.png)

![Image The Week in U.S. Politics [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/03/Lima-Charlie-Week-in-Politics-01-480x384.jpg)

![Image Memorial Day may soon be a remembrance of democracy and those who had the courage to defend it [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/05/Memorial-Day-may-soon-be-a-remembrance-of-democracy-and-those-who-had-the-courage-to-defend-it-Lima-Charlie-News-480x384.png)

![The Mind of Bolton - AUMF and the New Iran War [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/05/Inside-the-mind-of-Bolton-Lima-Charlie-News-main-01-480x384.png)

![Image Drop in oil prices may trigger unintended consequences [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/11/main_900-150x100.jpg)

![Image Saudis push OPEC, Russia to raise oil prices [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/04/Saudis-push-OPEC-Russia-to-raise-oil-prices-150x100.png)