Trump’s efforts to drive China to the negotiating table have been rocky for the U.S. President, but they have shown that even China has to concede to market forces.

Today a car made in Detroit is likely a composite of parts made in ten other countries. That means that increased tariffs on imports are not just a tool in the economic war against the outside world, but they are also a blow against one’s own nation. Tariffs are a double edged sword that few understand the gravity of wielding.

Therefore, it was only a matter of time before China and the United States were forced to sit down at the negotiation table. At the G20 Summit in the city of Buenos Aires, Argentina the two economic super powers agreed on a three-month long truce in the ongoing trade war. The stock market soared on the following Monday as a result, with traders bringing out their extra colorful suspenders to celebrate the occasion.

But the deal is fragile, and three months is a short period of time when one deals with matters that paradoxically move both at the speed of light and the pace of an iceberg.

As is his norm, President Donald Trump exclaimed by tweet that China is now “taking away car duties”. As is also the President’s norm, his President-in-Tweet statement does not align with the facts. Rather, if official documentation and China are accurate sources of information, in the following 90 days the United States will abstain from the planned increase in tariffs, which would impose an increase of 10 to 25 percent on Chinese specific imports. In exchange, China agreed to buy a “very significant quantity” of products from the U.S., in areas such as agriculture, industry and energy.

In addition, China and the U.S. will enter negotiations over “structural changes” to China’s economic relations with the West, which hopefully means that the Chinese markets will be further opened up to the West. Long term, the most important aspect of the negotiations is the prospect that China might finally come to honor international intellectual property rights.

China has agreed to enter into negotiations on a number of issues with the United States. An appeasement which seems sufficient to halt the Trump administration’s plans on increased duties for the time being. However, we have yet to see if any Chinese concessions will be as significant as hoped in the end.

What started as a good week for the markets quickly soured.

….I am a Tariff Man. When people or countries come in to raid the great wealth of our Nation, I want them to pay for the privilege of doing so. It will always be the best way to max out our economic power. We are right now taking in $billions in Tariffs. MAKE AMERICA RICH AGAIN

— Donald J. Trump (@realDonaldTrump) December 4, 2018

Last Tuesday, Trump engaged in a celebratory round of tweets about the deal with China and one phrase, the President’s self description as a ‘Tariffs Man’, sent the markets reeling. What followed was a week of bleeding, with investors moving money over into government bonds.

In spite of his statements, the agreements made in Argentina have not officially fallen to pieces, and, if this is the end of the trade war, then it might very well prove Trump to be an effective negotiator. If so, it will likely be due to his unpredictability and self-bombastic mannerism. He does not follow the unwritten rules of diplomacy, and in the past has proven willing to leave the negotiation table without a contract rather than engage in the age-old act of ensuring that both sides are “equally unhappy”. In the past, the media has described his mannerism in terms of acting out in a childish fashion, but if this is successful then the proof is in the pudding.

Seemingly, Trump is acting to keep his voting base reasonably happy — his base being the most immediately vulnerable and exposed domestic sufferers in the trade war — along with the stock market. And the stock market is the one place where tariffs are always, no matter the reasoning behind them, unpopular. However, popular or economically efficient Trump’s saber rattling proves to be, it did at least get China to come to the negotiating table.

China’s increasing economic and military strength is of concern to both the European Union (EU) and the United States, not to mention its Asian neighbours. But the more China has opened up to the global trade and internal market economies, the more vulnerable it has become to market dynamics. Chinese President Xi Jinping may be the leader of the world’s biggest dictatorship, but, even as Communist China is stronger than ever, Xi’s leadership is far more vulnerable than Mao’s.

The stock exchanges in Shanghai, Zhenzhen and Hong kong S.A.R. react to world wide developments. Good and bad news impact them directly and at times severely. Understanding this, in periods of market turmoil the government has been experimenting with purchasing shares, temporarily shutting down the exchanges or closing trade on individual stocks. But it is hardly a sustainable practice to force private investors, especially foreign operators, to retain shares that they no longer wish to hold for months at a time. This kind of behavior is hardly inspiring professional economists and investors to engage the Chinese markets.

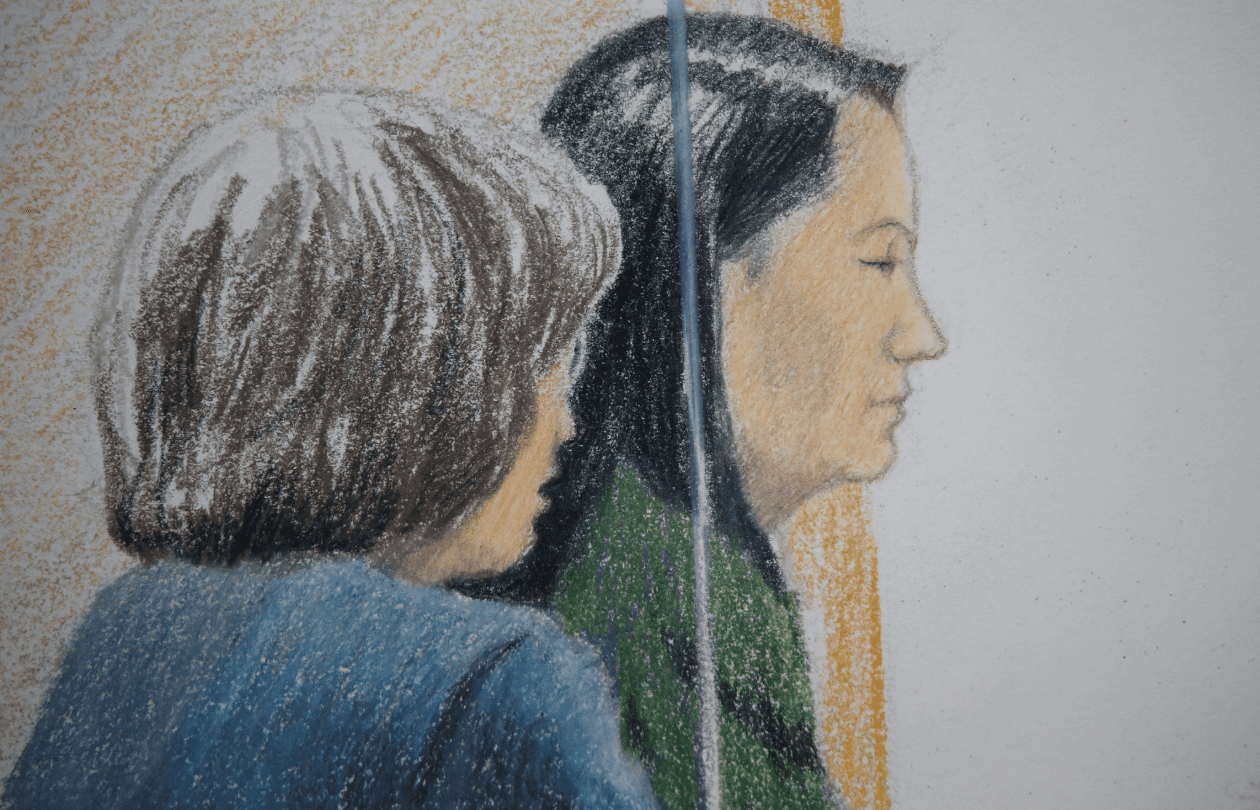

Similarly, the Chinese government continues to keep its internationally exporting technology companies close to its intelligence services, and thus deeply entrenched with its interests. This makes the world at large unable to trust the products. This is something that the telecom giant Huawei has felt. The company is barred from selling equipment in the U.S., for security reasons. Further, Huawei is not allowed to deliver its new 5G equipment to Australia, nor to Spark, the largest New Zealand mobile service provider. The governments of both Germany and the United Kingdom are also considering barring Huawei from operating within their borders. If both of those key governments were to follow through with such restrictions, a EU-wide ban may not be far off.

The company’s woes are expanding with Canada’s arrest of the Huawei’s CFO for evading U.S. sanctions on Iran. The CFO is also the Daughter of Huawei’s founder. Thus far, the Chinese government is defiant with regard to the arrest, and summoned the U.S. Ambassador over the incident.

The future of Sino-American trade relations is obscure, but some truths have emerged. If big investors lose confidence in the Chinese business community, it will be difficult to do business in the United States and Europe. If China wants to be part of the global trade in rich democracies, they will be forced to bow to the judgement of the market, and perhaps (by extension) the Trump-administration.

Title Image: (Qilai Shen for The New York Times)

John Sjoholm, Lima Charlie News

John Sjoholm is Lima Charlie’s Middle East Bureau Chief, Managing Editor, and founder of the consulting firm Erudite Group. A seasoned expert on Middle East and North Africa matters, he has a background in security contracting and has served as a geopolitical advisor to regional leaders. He was educated in religion and languages in Sana’a, Yemen, and Cairo, Egypt, and has lived in the region since 2005, contributing to numerous Western-supported stabilisation projects. He currently resides in Jordan. Follow John on Twitter @JohnSjoholmLC

Lima Charlie provides global news, featuring insight & analysis by military veterans and service members Worldwide.

For up-to-date news, please follow us on twitter at @LimaCharlieNews

In case you missed it:

![Image Huawei – China’s telecom giant hits a giant wall [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/01/Huawei-–-China’s-telecom-giant-hits-a-giant-wall-480x384.png)

![Image Tariffs – a mixed blessing for American businesses [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/12/Tariffs-–-a-mixed-blessing-for-American-businesses-Lima-Charlie-News-480x384.png)

![image Resistance mounts against China's President Xi Jinping [Lima Charlie News][Photo: Johannes Eisele / AFP]](https://limacharlienews.com/wp-content/uploads/2018/08/Resistance-mounts-against-Chinas-President-Xi-Jinping-480x384.jpg)

![Image Memorial Day may soon be a remembrance of democracy and those who had the courage to defend it [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/05/Memorial-Day-may-soon-be-a-remembrance-of-democracy-and-those-who-had-the-courage-to-defend-it-Lima-Charlie-News-480x384.png)

![The Mind of Bolton - AUMF and the New Iran War [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/05/Inside-the-mind-of-Bolton-Lima-Charlie-News-main-01-480x384.png)

![Image Huawei – China’s telecom giant hits a giant wall [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/01/Huawei-–-China’s-telecom-giant-hits-a-giant-wall-150x100.png)

![Image Tariffs – a mixed blessing for American businesses [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/12/Tariffs-–-a-mixed-blessing-for-American-businesses-Lima-Charlie-News-150x100.png)