Highlights of the week in finance, investment, emerging-markets, risk, and crypto markets from Lima Charlie Business Intel. This week’s report covers Brazil, the Southern Cone Economies (Argentina, Bolivia, Uruguay, Paraguay and Chile), the Andean Economies (Ecuador, Colombia, Peru, and Venezuela), the Caribbean, Ghana, Ivory Coast, China, Russia, Turkey, Azerbaijan, and the United States.

Political Finance Spotlight: Brazil

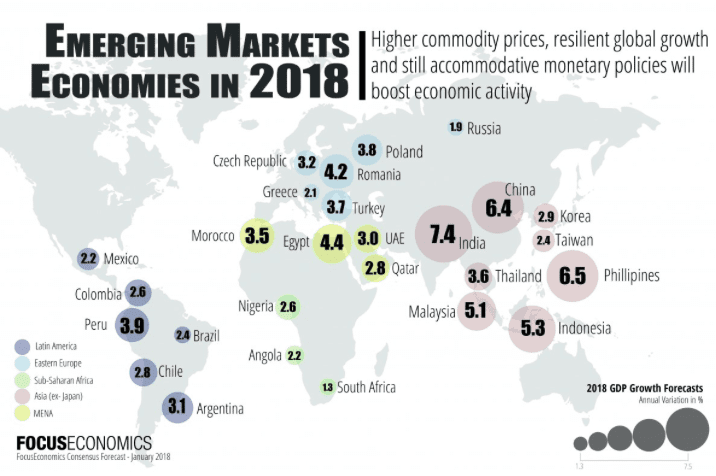

According to GeoQuant, a platform which quantifies political factors to compare risks across markets, emerging-market political risk has climbed to its highest level since June of 2016.

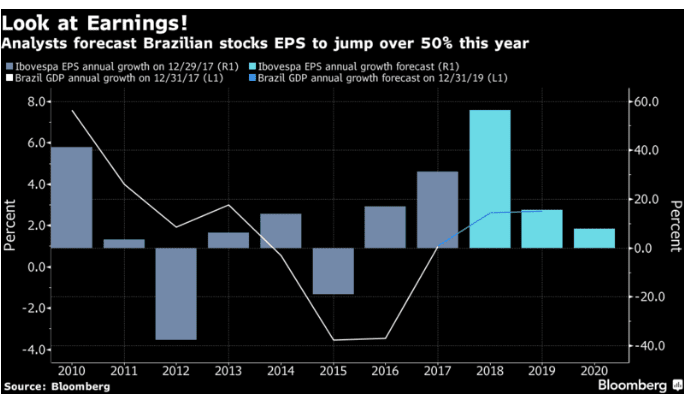

Emerging-market investors, in particular, are preparing for a historic election in Brazil, a nation in the midst of its worst economic recession in decades. Following a historic corruption probe, the impeachment of former President Dilma Rousseff and the nomination of Michel Temer as her temporary successor, the newly elected leader will be a signpost for investors and markets, alike, as to the financial prospects of the country.

Brazilians are set to vote in a new leader, as well as a brand new Congress, with Partido da Social Democracia Brasileira candidate Geraldo Alckmin drawing comparisons to the US’ Hillary Clinton and far-right Partido Social Cristao candidate Jair Bolsonaro being dubbed the Donald Trump of Brazil.

Risk perception has improved in the nation, with financial market investors portending that a moderate, market-friendly candidate will emerge victorious this October. Perhaps the greatest testament to this possibility is the increase of Brazil’s Ibovespa stock index by more than 12%, with investors’ confidence increasing in a post-recession 2018 Brazil.

Luiz Inacio Lula da Silva’s candidacy, as a charismatic member of Partido dos Trabalhadores may throw a wrench into the mix. A Brazilian appeals court will decide the fate of Silva, who was caught up in a corruption scandal which may preempt him from running for president.

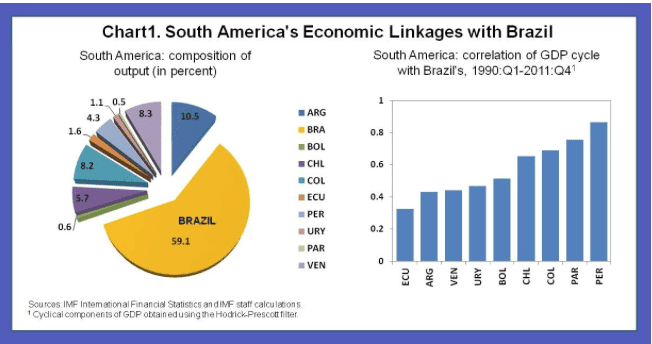

Geopolitically, Brazil constitutes South America’s largest economy and is a critical trading giant in the region. Silva’s election could impact Brazilian relations with its neighbors. Silva is anti-market and pro-interventionist, which signifies a great deal of risk for investors, as well.

According to a recent IMF Report on Regional Economic Outlook, investors have turned a critical eye toward what are known as the South American Southern Cone economies of Argentina, Bolivia, Uruguay, Paraguay and Chile, which have high export exposures to Brazil, in comparison to the Andean countries such as Ecuador, Colombia, Peru, and Venezuela with limited connections, trade-wise, to Brazil.

For past and future coverage of global politics and finance, check out Lima Charlie’s weekly Business Intel Report and Politics Review.

Pipeline Politics & Peace

The Trans-Anatolian Pipeline Success & Market Potential

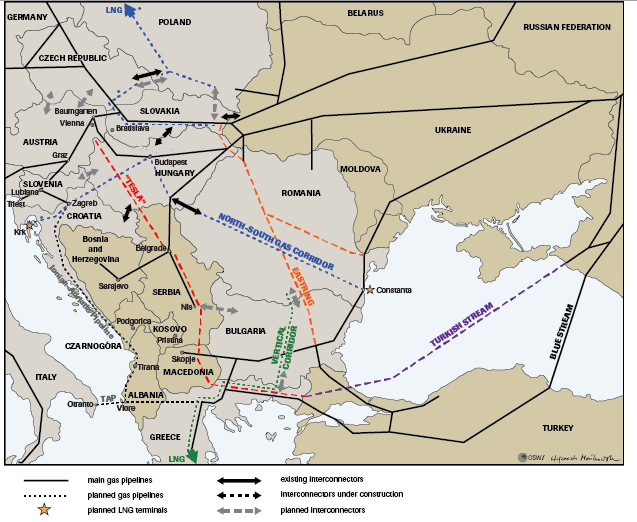

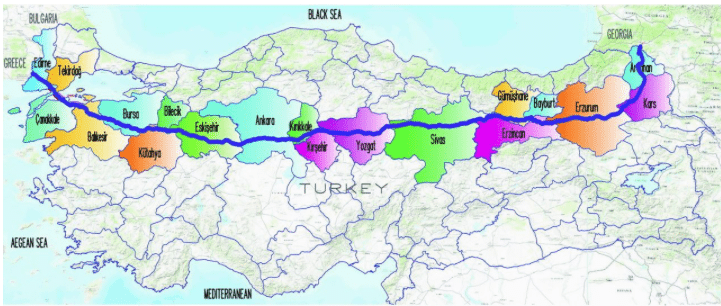

This week, the Trans-Anatolian Gas Pipeline (TANAP) received approval from the European Investment Bank (EIB) for 932 million Euros, in order to build the structure across Turkey and transfer gas from Azerbaijan to European and Turkish markets.

Geopolitically, Turkey’s positioning in the Eastern Mediterranean is strategically advantageous in regard to energy supply. Turkey’s positioning and advantage lies in its placement amidst energy rich territories in the Middle East and Caucasus and the West.

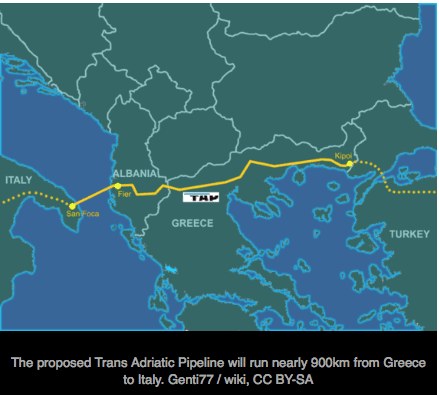

The US has attempted to strengthen diplomatic ties with Azerbaijan in the interest of these burgeoning prospects, given that the TANAP is just one aspect of a larger Southern Gas Corridor opportunity that would link a large gas field located in the Caspian Sea to Italy, across Azerbaijan, Turkey, and Albania, as depicted below.

The issue this poses for investors is that renewable energy is seen as a better option given the lower risk exposure it projects. Nevertheless, the recent investment by EIB may signal to the same investors that renewable energy is not the future of profitability, though only time will tell.

For more coverage on Turkey, the pipeline, and developing stories in the region, check out Lima Charlie’s Weekly Middle East North Africa (MENA) Brief, written by our MENA Chief, John Sjoholm.)

China & Latin America: An Emerging Trading Ground

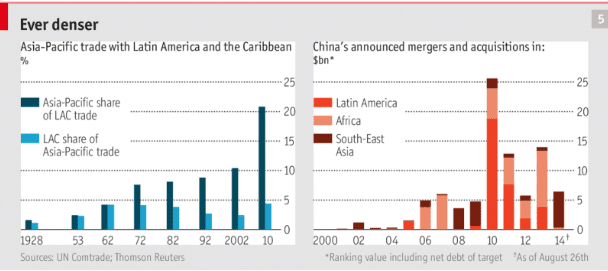

Just three years ago, Chinese leader Xi Jinping announced plans to trade $500 billion dollars with Latin America and the Caribbean region, along with $250 billion dollars in direct investment. The flow of cash occurs in two primary forms—direct investment such as greenfield investments plus mergers and acquisitions, and lending through China’s policy banks.

What many investors viewed as a lofty goal is on the path to fruition in 2018. With China pushing past the United States as leading trading partner of many key South American countries, such as Brazil, many other countries are lowering their investment figures.

According to a report from the UN Economic Commission for Latin America and the Caribbean, Foreign Direct Investment in Latin America and the Caribbean dipped significantly on the whole for 5 consecutive years from 2011 to 2016, increasing China’s share considerably.

Geopolitically, Donald Trump is set to make his first visit to Latin America, in his current position as president, in April. Xi, conversely, has taken trips to the region three times in the last six years. China’s increasing presence in Latin America has edged the US out, especially following Panama’s recent announcement to sever ties with Taiwan and take Beijing under its wing. Latin America is likely to welcome competition between a Beijing increasing in its sphere of influence and a US that appears to be waning, reaping economic advantages and leading investors to keep a close eye on Chinese financial encroachment into Latin America.

For more coverage of the unfolding events in the region, check out Lima Charlie’s South America reporting.

Burgeoning West African and Sub-Saharan Industries:

West Africa Named Best Emerging Investment Destination as Largest Euro Debt Is Issued in 21st Century

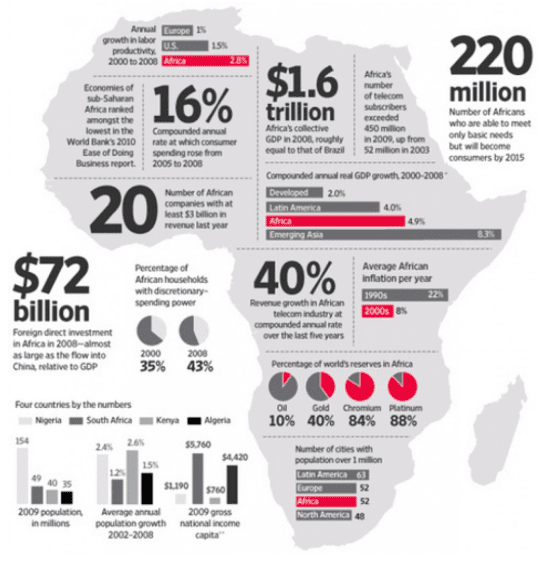

As of 2018, according to a survey, Limited Partners by Emerging Market Private Equity Association (EMPEA) ranked sub-Saharan Africa as the 4th most attractive emerging market behind India, South America (not including Brazil), and Southeast Asia. In total value, African Private Equity fundraising between 2010 and 2017 was upwards of 20 billion dollars.

In West African news, Ivory Coast was Africa’s fastest growing economy in 2016, as presented by figures from the International Monetary Fund (IMF). In comparison to sub-Saharan Africa’s 3% growth, Ivory Coast has produced upwards of 8% in growth. As well-established leaders in South Africa, Ethiopia, Angola, and Zimbabwe have fallen, investors look to West Africa in particular as the Ivory Coast announced a 7 billion dollar infrastructure plan. As a major player in West African economies, Ivory Coast’s GDP expanded by 7.6% last year. Just 4 years ago, the African Development Bank returned to Abidjan, signaling to investors a growing confidence in the region. Geopolitically, even Japan has shown major support of the Bank and its transformation of Africa’s private sector and energy and infrastructure plans which have seen key boosts from Japan’s participation.

On Thursday, according to Bloomberg, Ivory Coast sold 1.7 billion euros (or $2.1 billion) of bonds, constituting the most substantial issuance in the common currency from an African government since the start of the 21st Century. The move represents a growing trend of African countries which are able to borrow in international financial markets, having been once constrained by foreign assistance or loans from international financial institutions to supply their currency needs.

The ability to raise funds in international debt markets indicates to investors rapid growth and a greater preference, given that Eurobonds are distinguished in that they are largely unregulated. US dollar bonds in the Japanese market, for example, require SEC approval, whereas the former do not. For an investor, this signals an ability to bring the bonds into the market with minimum disclosure and greater speed.

As represented in the Bloomberg image below, Ivory Coast’s recent move represents the second-largest euro deal from emerging markets in 2018.

Looking geopolitically, the move comes just as Ivory Coast has demonstrated a boost in thermal energy production. A burgeoning thermal energy production market is likely to be one contributing factor to Ivory Coast’s increasingly central position in Western Africa as a site to keep close watch on for investors and markets, alike.

Ghana, a country which first emerged on the oil landscape around 2010, is likely to see an oil boom which will alter the energy landscape in Africa. According to a new report by the New York Times, Ghana is poised to emerge as the world’s fastest growing economy with an 8.3% expansion in 2018. The move comes just one year after the country secured a deal with a Chinese firm for a major gas pipeline project. Even the Ivory Coast announced plans to invest about 1 billion dollars to start construction of an oil pipeline, demonstrating great desire to cement the highly coveted number-one position as oil producer giant in West Africa.

For more coverage on the burgeoning markets across the African continent, check out Lima Charlie’s reporting on the region.

Crypto Finance

First-Ever Cryptocurrency Hearing

According to a memorandum from the US House of Representatives Committee on Financial Services, the US HOR Capital Markets, Securities, and Investments Subcommittee held its very first cryptocurrency hearing on March 14. The central topic at the meeting was regulation of digital assets with many representatives agreeing that cryptocurrency should be categorized as commodities given their scarcity and decentralized nature. On the other hand, assets offered in an ICO and capital-raising efforts were suggested to be categorized as securities.

Perhaps the most important factor for investors in this debate is whether digital assets are a security or a commodity, determining which body the asset will fall under the jurisdiction of in the HOR, impacting regulation decisions and overall speculation for the market throughout 2018.

Google Bans Crypto-Ads

According to newly appended advertising policies, Google has moved to ban all ads on cryptocurrency content, such as initial coin offerings, wallets, and overall advice from any of its products on its own sites and through third-party websites, following suit with Facebook’s similar decision in 2017.

With an eye to the impact of the move on investors, the decision is unlikely to impact the true funding of cryptocurrency ventures, continued expansion in this arena, or the addition of new currencies to the market, as reported below.

CryptoMarket: The Top 25

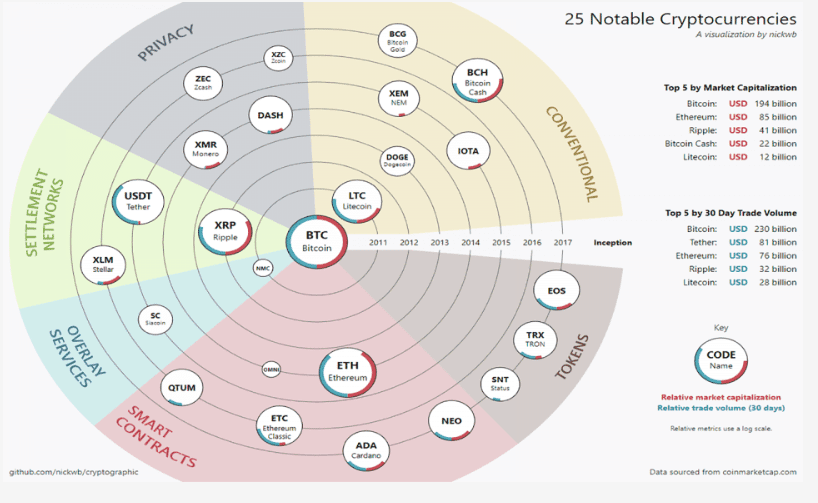

Despite major regulatory setbacks, the crypto market shows no signs of slowing down. With Bitcoin as a notable giant in the space, a recent report shows more than 1,000 other tokens and upwards of 20 cryptocurrencies which have reached the $1 billion dollar threshold in market capitalization.

As seen below, the graphic presents the top 25 cryptocurrencies by metrics of 30-day trading volume, launch date, and market capitalization. The function of each coin is also provided.

While Bitcoin’s share of market capitalization was about 80% in 2017, this year it is around 42%, with newer currencies vying for the top-level spot.

Downward Overall Trend in CryptoMarket

Following regulatory restrictions, the cryptomarkets experienced a downward dip by week-end as market capitalization for the cryptocurrency industry dropped to $309 billion from its position at $400 billion at the beginning of the week.

Ethereum dropped below the threshold of $600, having reached a peak at $1,400 at the beginning of 2018, and Ripple dropped by 15 cents, from 0.80 to 0.65, within the course of the last day. With investors looking at market prices across the space, the drop in overall prices—most notably ripple and ethereum—signals a stalling of what has been a more continuous long-term burgeoning of the cryptomarkets.

For more coverage on developing Cyber and Crypto stories, check out Lima Charlie’s reporting here.

Saudi Arabia Has First Open Spat With Euro Ally Since 2015

Deutsche Bank AG mandates are among those contracts in danger as Saudi Arabia’s friction with Germany came to a head earlier this week. The kingdom announced it would be rolling back interactions with some German companies following a disagreement with its central European trading partner. Germany is the leading European trading partner for Saudi Arabia and its top-three largest source of imports globally. Diplomatic communications between the two countries have grown aggressive, leading to a tipping point. Germany’s former foreign minister, Sigmar Gabriel recently made comments which strained the relationship, although essential business will endure.

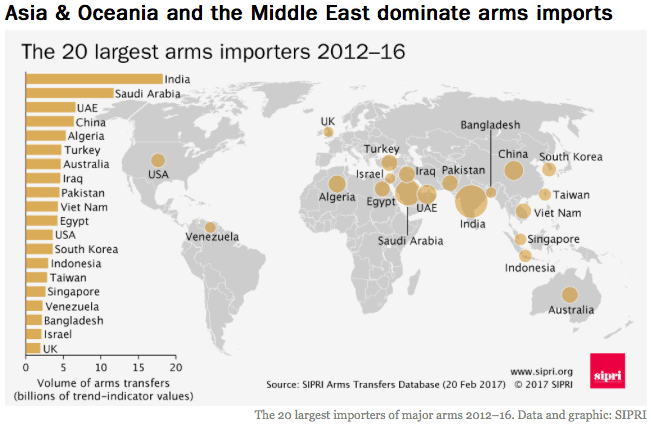

In connecting the diplomatic dots, the move comes at the same time that Saudi Arabian minister Adel al-Jubeir has announced the kingdom will “find its weapons somewhere else.” Of note, Saudi Arabia has been at the forefront of an alliance of nine states in opposition to the Houthi rebel fighters, backed by the Iranians. While Saudi Arabia has been one of Germany’s most loyal customers for arms exports, Germany recently announced it would no longer issue arms shipment permits to nations which are participants in the war in Yemen.

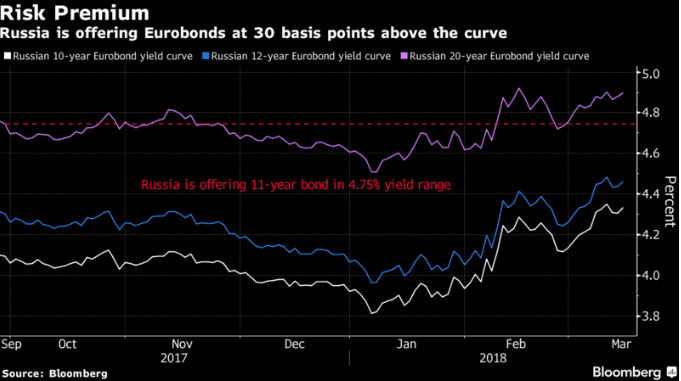

Investors Bid for Double Russia’s Floated Eurobond Despite First Chemical Weapons Attack on Western Europe Since Cold War & US-Russia Sanctions

Friction between the West and Russia reached a head following the poisoning of former Russian intelligence officer Sergei Skripal and his daughter on English soil. According to British Foreign Secretary Boris Johnson, it is probable that Putin authorized the attack to use a military-grade nerve toxin on the former Russian state member. Immediately following the attack, the Russian Ruble hit a 1-month low as Britain, Germany, France, and the US all implored Russia to explain the act and the country’s involvement in it.

On Thursday, Treasury Secretary Mnuchin, according to a released statement, designated 5 entities and 19 individual persons to whom the punishment is directed as a result of malicious cyber activity. In particular, the NotPetya cyberattack was cited as the source of billions of dollars in damage to Asia, Europe, and the United States.

Investors are concerned about recent announcements from the UK, asserting that punitive action will be taken, given that measures against assets such as BP’s 1/5 stake in Russian oil and gas leader Rosneft would give Russia great leverage given its hold over the company. As reported by the BBC, for example, following its encroachment into Crimea, Russia instructed Rosneft to use a Russian number for all phones, or license suspension would take place.

Despite this, reports surfaced earlier this week that Russia was planning to sell 7 billion dollars of Eurobonds in an attempt to thumb its nose at the sanctions and international outcry. Investors jumped at the opportunity, according to Bloomberg, bidding for approximately double the eventual 4 billion dollar ending figure.

For recent coverage on Russia, check out some of Lima Charlie’s articles on the region here.

Largest Chinese Revamp Since Establishment of People’s Republic To Take Place

The symbol of the Chinese financial structure for the last decade, Zhou Xiaochuan, is expected to announce his retirement at the beginning of next week. On the heels of a recent decision by the government to overhaul the bank and provide it with new regulatory powers over neighboring institutions, the move comes at the same time as the government plans to merge its banking and insurance regulators. In an effort to bring uniformity to the two sectors and send a single message from both bodies, Xiaochuan’s successor will exercise power over an institution with enormous international power.

The successor to lead the organization will be responsible for controlling credit growth, a key arena of interest for foreign investors. Likely contenders for the position are Jiang Chaoling, party secretary and banker hailing from Hubei province, Guo Shuqing, leader of the banking regulator, and Yi Gang, deputy governor.

The decision also includes providing the central bank with the authority to dictate the financial sector’s regulations, making this developing situation a key subject of interest for global investors.

For more coverage on the events in China, check out Lima Charlie’s coverage here.

Dodd-Frank Rollback

On Wednesday, the Senate passed a bipartisan-backed bill to roll back certain stipulations of the 2010 Dodd-Frank banking law passed during the Obama administration. 17 of the 67 votes in favor of the bill were from Democrats. The law was initially passed to protect investors from the possibility of another financial crisis.

Among those in support of the bill were Tim Kaine, Claire McCaskill, and Doug Jones. Among some of the key provisions of the bill are increasing the level at which banks are considered “systematically important financial institutions” from $50 billion dollars to $250 billion dollars.

The Volcker Rule was another contentious issue surrounding the debate on this bill and the final copy of the document exempts banks with less than $10 billion dollars in assets from this regulation which prevents high-risk investments with federally backed deposits.

Stocks, Oil, Jobs & General Markets

While stocks rose periodically throughout the week, they posted losses by week-end, following exits by US Secretary of State Rex Tillerson and heightening trade tensions.

The S&P experienced a 1.2% loss for the week but had a 0.2% increase on Friday. The Dow Jones industrial average dropped 1.5% and the Dow closed 72.85 points higher by week-end at 24, 946.51.

Although oil spiked on Friday, hitting its peak since early March, it settled above $61, posting gains.

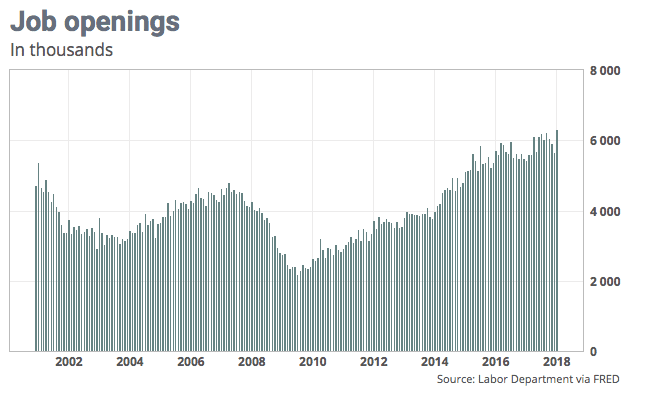

According to the most recent Job Openings and Labor Turnover Survey, job openings spiked to a record 6.3 million, a metric that is closely monitored by the Federal Reserve as an indicator of future employment conditions.

Suggested reading: This week’s MENA Brief:

LIMA CHARLIE NEWS

[Edited by Nikita Roach]

Lima Charlie provides global news, insight & analysis by military veterans and service members Worldwide.

For up-to-date news, please follow us on twitter at @LimaCharlieNews

In case you missed last week:

![Image This Week in Business Intelligence [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/03/This-Week-in-Business-Intelligence-Lima-Charlie-Business-Intel-Report.png)

![Image The Alevis Dilemma [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/04/Alevis-Erdogan-480x384.png)

![Image The Trouble With Turkey’s Economy [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/02/Trouble-with-Turkeys-Economy-01-480x384.jpg)

![Image Memorial Day may soon be a remembrance of democracy and those who had the courage to defend it [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/05/Memorial-Day-may-soon-be-a-remembrance-of-democracy-and-those-who-had-the-courage-to-defend-it-Lima-Charlie-News-480x384.png)

![The Mind of Bolton - AUMF and the New Iran War [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/05/Inside-the-mind-of-Bolton-Lima-Charlie-News-main-01-480x384.png)

![Image The Alevis Dilemma [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/04/Alevis-Erdogan-150x100.png)