Lima Charlie Business Report | Saudi Arabia | MENA

Saudi Arabia’s King Salman bin Abdulaziz Al Saud announced the release of 72 billion riyals (US $19.2 billion) worth of measures to promote growth in Saudi Arabia’s private sector on December 14th. The measures are designed to relieve the economic slump caused by dropping crude-oil prices.

Saudi Arabia put austerity-measures in place initially to combat the economic effects of the drop in oil prices. The new measures are designed as longer-term relief, and are part of Saudi Arabia’s overall plan to expand its economy in a post-oil world, and attract investors. Still more challenges await the Saudi Arabian economy, due to a 5 percent value-added tax that will take effect in January, and domestic energy price increases.

Additionally, legal reforms will be put in place governing bankruptcies. Saudi Arabia does not currently have a cohesive set of laws to handle bankruptcy cases. This has left creditors and borrowers hanging in the balance with no resolution.

Commerce and Investment Minister Majid Al Qasabi said he expects the new bankruptcy laws to take effect within three months.

Al Qasabi said, “Uncertainty is the enemy of investment. We need to restore investor confidence in Saudi Arabia. We need to benchmark against other countries that have these laws.”

Overall, the new stimulus package includes residential loans worth 21.3 billion riyals, 10 billion riyals to support economic projects, as well as 1.5 billion riyals to help companies in financial distress.

2.8 billion riyals will be allocated by the government to invest in small businesses, and the government will adjust the fees it charges, in order to relieve small businesses of as much as 7 billion riyals.

Although the specifics of the plan are yet to be released, money would be allocated to develop the kingdom’s broadband infrastructure, as well as development of more modern construction practices. Saudi Arabia’s current unemployment rate is 12.8 percent, and authorities are desperately trying to keep the Saudi Arabian private sector from going into a recession. Al Qasabi states that there are 17 initiatives in the package designed to promote private sector growth and reduce unemployment, by creation of jobs directly and indirectly.

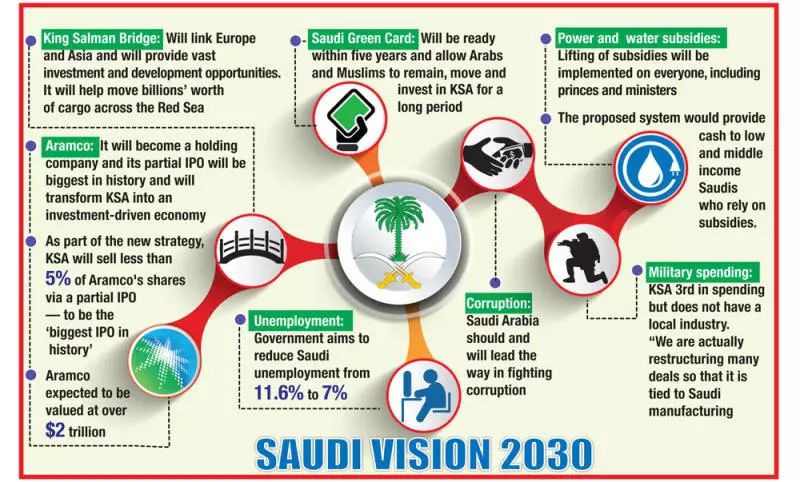

The new stimulus package is a major component of the kingdom’s Vision 2030 economic-transformation plan ahead of the 2018 budget, which is due next week. Cabinet adviser Fahad al-Sukait, speaking with reporters on Thursday, said these were part of a four-year, 200 billion riyal program to help private sector businesses.

The 72 billion riyal package will be spent over the course of four years, including 24 billion to be spent in 2018.

“Next year is the year for stimulus,” Al Qasabi stated, adding, “That’s how we will strengthen our bonds with local and international investors.”

Al Qasabi maintained that the first state-owned industries the government will most likely privatize are logistics and municipal utilities. Additionally, it’s anticipated that some port activities will be sold by late 2018, with water, sewage and public parking industries following those.

MENA focus continues to remain on the Kingdom, and its economy since the November “pre-emptive coup”.

LIMA CHARLIE NEWS

Lima Charlie provides global news, insight & analysis by military veterans and service members Worldwide.

For up-to-date news, please follow us on twitter at @LimaCharlieNews

In case you missed it:

![Image The Arabs - a "Manufactured" People? [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/12/Arabs-A-Manufactured-People-Lima-Charlie-News-480x384.png)

![Image Drop in oil prices may trigger unintended consequences [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/11/main_900-480x384.jpg)

![Image The Right Response to the Death of Jamal Khashoggi [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/10/The-Right-Response-to-the-Death-of-Jamal-Khashoggi-Lima-Charlie-News-480x384.png)

![Africa’s Elections | In Malawi, food, land, corruption dominate [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/06/Malawi-election-Food-land-corruption-480x384.jpg)

![Syria’s oil, gas and water - the Immiscible Solution to the War in Syria [Lima Charlie News][Photo: ANDREE KAISER / MCT]](https://limacharlienews.com/wp-content/uploads/2019/05/Syria’s-oil-gas-and-water-480x384.png)

![Image The Rwandan Jewel - Peacekeepers, Conflict Minerals and Lots of Foreign Aid [Lima Charlie World]](https://limacharlienews.com/wp-content/uploads/2019/03/Rwanda-Jewel-480x384.jpg)

![Image Russia's energy divides Europe [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2019/03/Russias-energy-divides-Europe-Lima-Charlie-News-480x384.png)

![Image The Arabs - a "Manufactured" People? [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/12/Arabs-A-Manufactured-People-Lima-Charlie-News-150x100.png)

![Image Drop in oil prices may trigger unintended consequences [Lima Charlie News]](https://limacharlienews.com/wp-content/uploads/2018/11/main_900-150x100.jpg)